Don't Overlook Taxes on Social Security Benefits

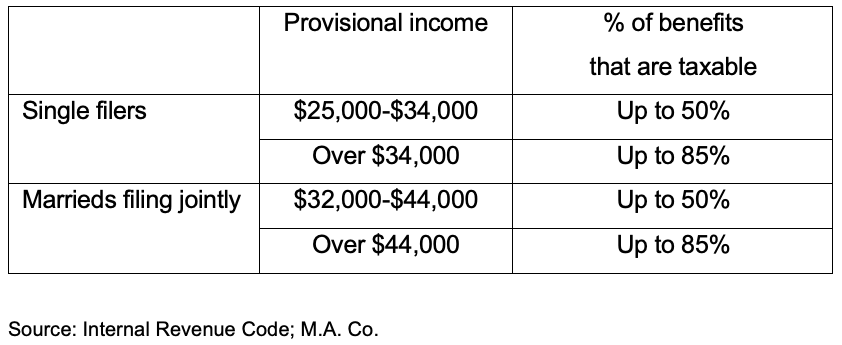

More and more retirees are paying income taxes on their Social Security benefits, because the thresholds for this taxation are not indexed for inflation. The computation of this tax is not simple. It starts with a determination of “provisional income,” which is modified adjusted gross income plus half of Social Security benefits plus all tax-exempt interest from municipal bonds or mutual funds that invest in such bonds. As provisional income rises, more and more of the Social Security benefits become taxable, up to 85%, as shown in the table below.

Calculating the tax on Social Security benefits

There are some strategies that may reduce this tax bite

-

Delay taking Social Security benefits. Benefits are increased by 8% for each year of delay after reaching normal retirement age. By delaying the benefits, retirement expenses will have to be met from taxable and tax-deferred savings. Spending those resources down may reduce portfolio income by age 70 enough to lower the overall tax burden, even though the benefits will be higher.

-

Invest for growth instead of income. Capital gains are not taxable until they are realized by selling the security, and then they are more lightly taxed if they have been held for at least 12 months.

-

Convert IRAs to Roth IRAs. The conversion of an IRA to a Roth IRA is taxed as ordinary income, and that can be a substantial hit. The potential benefit is that distributions from the Roth IRA may be tax-free and won’t be counted in provisional income. What’s more, there are no required minimum distributions from Roth IRAs at age 73 and up, as there are for traditional IRAs. To ease the tax bite on the conversion, it might be done in smaller increments over a period of years.

-

Give IRA money to charity. A Qualified Charitable Distribution is a direct payment from an IRA to a qualified charity that is not included in taxable income, even though it satisfies the rule for required minimum distributions. Up to $100,000 may be transferred per year by those who are 70½ and older.

© 2023 M.A. Co. All rights reserved.

Some information provided in the Knowledge Center may be obtained from outside sources believed to be reliable, but no representation is made as to its accuracy or completeness. This information is intended for discussion purposes only and should not be considered a recommendation. The information contained herein does not constitute legal, tax or investment advice by Country Club Trust Company. For legal, tax or investment advice, the services of a competent professional person or professional organization should be sought. Trust services and investments are not FDIC insured, are not guaranteed by the Trust Company or any Trust Company affiliate, and may lose value. Past performance is no guarantee of future results.