Sell-Side M&A Process

One of the biggest decisions a business owner will make during their ownership is executing on strategic alternatives such as selling, raising institutional capital or acquiring another business. The process can take the better part of a year and will involve a team of outside advisors, potentially more than a hundred counterparties and several transaction documents.

The planning process should start two years before you want to take your company to market. The more work you do to ensure your business is sellable and ready to stand up to buyer’s diligence, the better chance you have of a successful outcome and above market valuation. Key areas to prepare include:

- Financial statement quality: Businesses are evaluated on accrual accounting, and variances from GAAP will need to be explained. Additionally, third-party accountant audited statements are valuable in demonstrating financial statement quality to potential buyers.

- Management team: If you are planning on retiring, having a supporting team is key

- IT Systems: Is the security and infrastructure adequate to support the business

- Growth Strategy: Buyers pay for growth opportunities, such as defined initiatives to capture increased market share, future product releases or expanded geographic reach

Once your business is ready to be taken to market you will need to build a team of advisors who specialize in the various aspects of mergers & acquisitions. This might be the only transaction you ever complete, it will benefit you to be surrounded by advisors who have successfully completed hundreds.

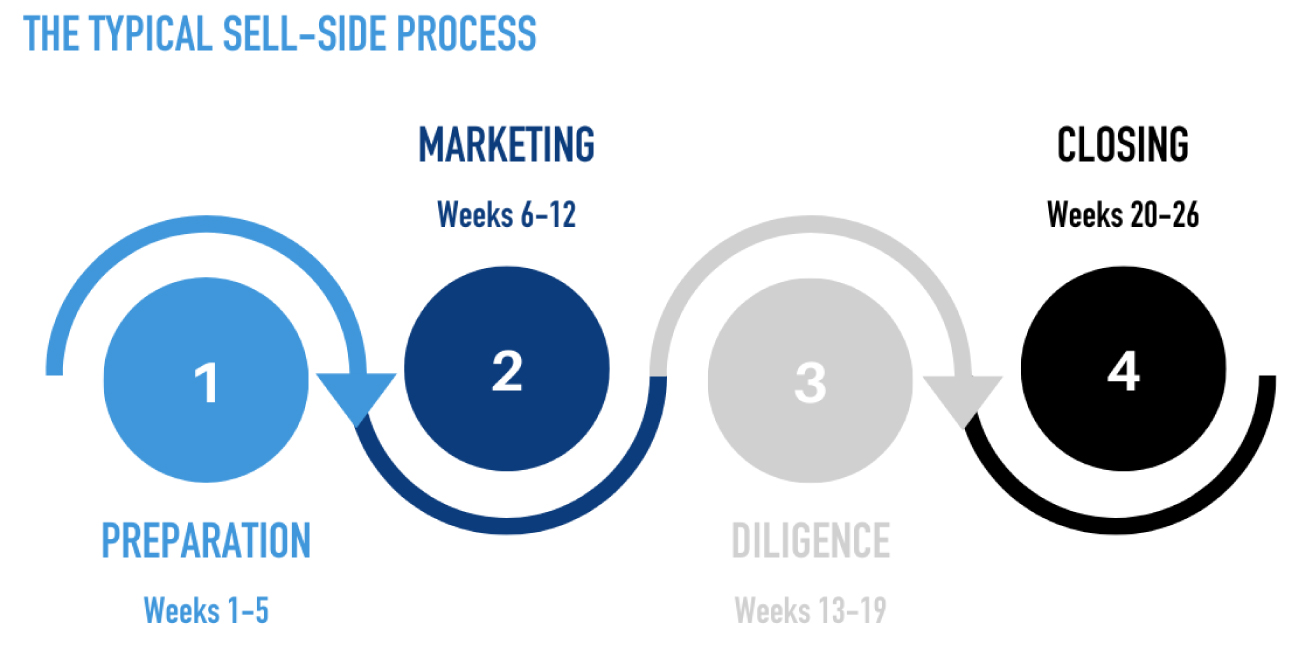

Preparation. Once an engagement is kicked-off the investment bank will work with you and your core management to development the “story” which will be the key component of the confidential information memorandum. A confidential information memorandum, or “CIM”, is in effect a marketing book that tells the story of the business to potential buyers. This story will focus on key investment highlights that buyers will evaluate and distill into their investment thesis. An advisor will develop a list of potential financial, strategic & sponsor-backed strategic buyers who will be shown the opportunity. There are 1,000s of private equity funds looking for deals and the investment bank will narrow the list to those that have a history and/or demonstrated appetite for the type, size and location of your business in order to streamline efficiency and increased competitive leverage. The preparation phase also provides an opportunity for an outside accounting firm to conduct a quality of earnings report, which will identify any potential issues that will come up during a buyer’s diligence. Being able to identify and strategize on how best to position any potential issues decreases risk during closing and results in higher quality bids during marketing.

Marketing. Once the preparation phase is complete the investment banking team will begin contacting buyers, executing non-disclosure agreements and distributing CIMs. Potential buyers will review the CIM and often come back with initial questions. The investment banking team will aggregate these questions, so the seller does not have to address the same questions multiple times. The marketing phase ends with buyers submitting indications of interest, where a buyer gives their valuation range for the business, high-level deal terms and provides their rationale on why they are the right buyer and should be included in the next round. You and your banking team will evaluate the strength of the offers and each group’s history of successfully completing transactions to select a group to move into diligence.

Diligence. The top bidders from the marketing phase will move into diligence where they will take a much deeper dive into your business. The counterparties that are selected for diligence will travel to your location to meet you and your management team and tour your facilities. This is the opportunity for both sides to evaluate each other to ensure there is a cultural fit as well. In addition, buyers will have access to a virtual data room with significantly more detailed information and a draft of the purchase agreement prepared by your transaction lawyer. Counterparties will submit a letter of intent, providing a single point of value for your business and key deal terms including the length of exclusivity needed for the buyer to close the transaction. Additionally, buyer’s legal counsel will provide their markup to the purchase agreement. The diligence phase ends when you select the winning bidder, execute the letter of intent, and move into closing.

Closing. The closing process is the first point where there is only one counterparty, therefore leverage generally shifts to the buyer. A buyer will bring in their third-party diligence providers that will simultaneously request diligence items, requiring you and your management team’s attention with calls and questions. General diligence work streams include:

- Accounting: financial statements, federal & local tax, sales & use and other taxes

- Legal: corporate, tax, human resources, litigation

- IT: systems, security

- Environmental: phase 1

- Human Resources: employment law, benefits

- Insurance: adequacy and economics

- Market Research: industry studies, client/customer interviews

In hand with diligence, both legal teams will continue to turn the purchase agreement and other transaction documents. The closing process typically takes between 45 and 75 days depending on the preparation of the seller and sophistication of the buyer.