A View from the Tower

Double Three in a Row

For the third quarter in a row, the final quarter of 2025 saw more of the same as the S&P 500 gained an additional 2.7%, resulting in a total return of 17.88% for the year, the third consecutive year of strong performance. Stock strength was relatively broad in nature, as depicted in the table above. Of particular note, post multiple juxtapositions during 2025, the Russell 1000 Growth Index rose by 18.6% while the Russell 1000 Value posted a very competitive 15.9% return. Additionally, after several years of lagging performance, international developed and emerging market equities catapulted by nearly 31.2% and 33.6 % respectively. Not to be left out, the broad bond market extended its rally as the Barclays Intermediate Government/Credit index posted nearly a 7.0% return for the year. Lastly, although metals in general, and gold specifically, had strong years, oil prices fell significantly.

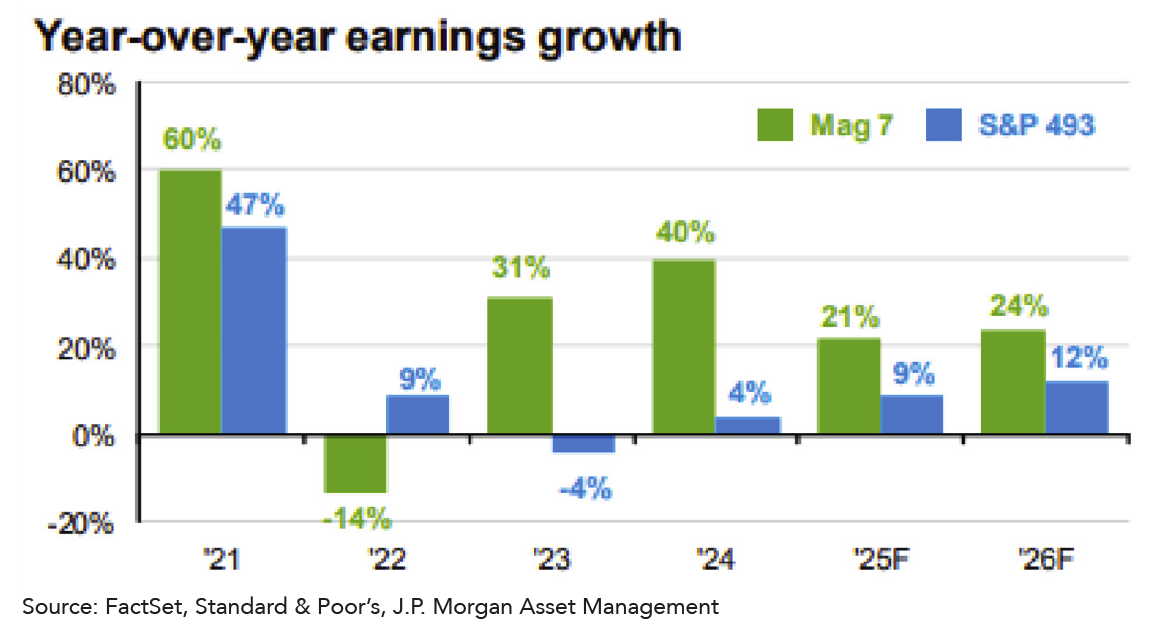

Why did stocks continue to perform so well, with indices hitting multiple record highs during the quarter, even in the face of what some would consider a somewhat uncertain economic environment, including an extended U.S. government shutdown and possibly a tale of two economies? Predominantly robust corporate profits and positively trending inflation (not to be confused with “affordability”) data, despite ongoing concerns on the tariff front. A slowing, but relatively stable labor market was also well digested.

Speaking of the Economy...

Often, people tend to look at one statistic or fact and arc to what they consider to be a straightforward and definite conclusion. This can happen in various aspects of our lives, including our economic views. However, when considering that the U.S. has a $30 trillion economy, we might be better off contemplating this in the context of a matrix versus a straight line.

Within this perspective, not ignoring the current headwinds, one should not completely discount the following potential positive facets:

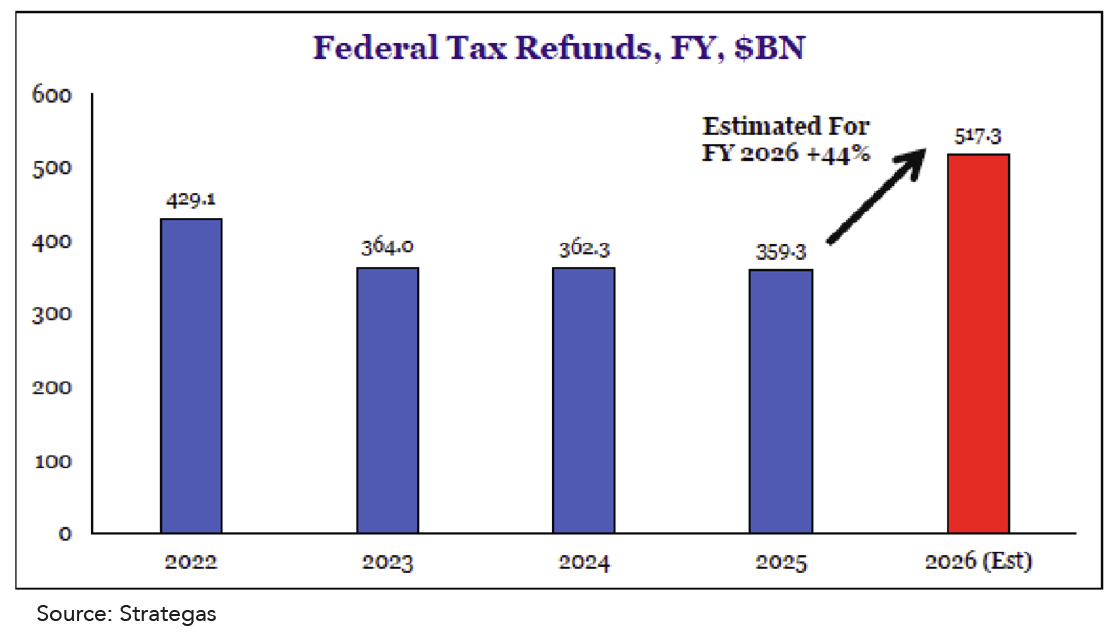

- A healthy wave of anticipated income tax refunds during the early portion of 2026

- Likewise, significant business-related tax cuts

- Deregulation, including on the banking front

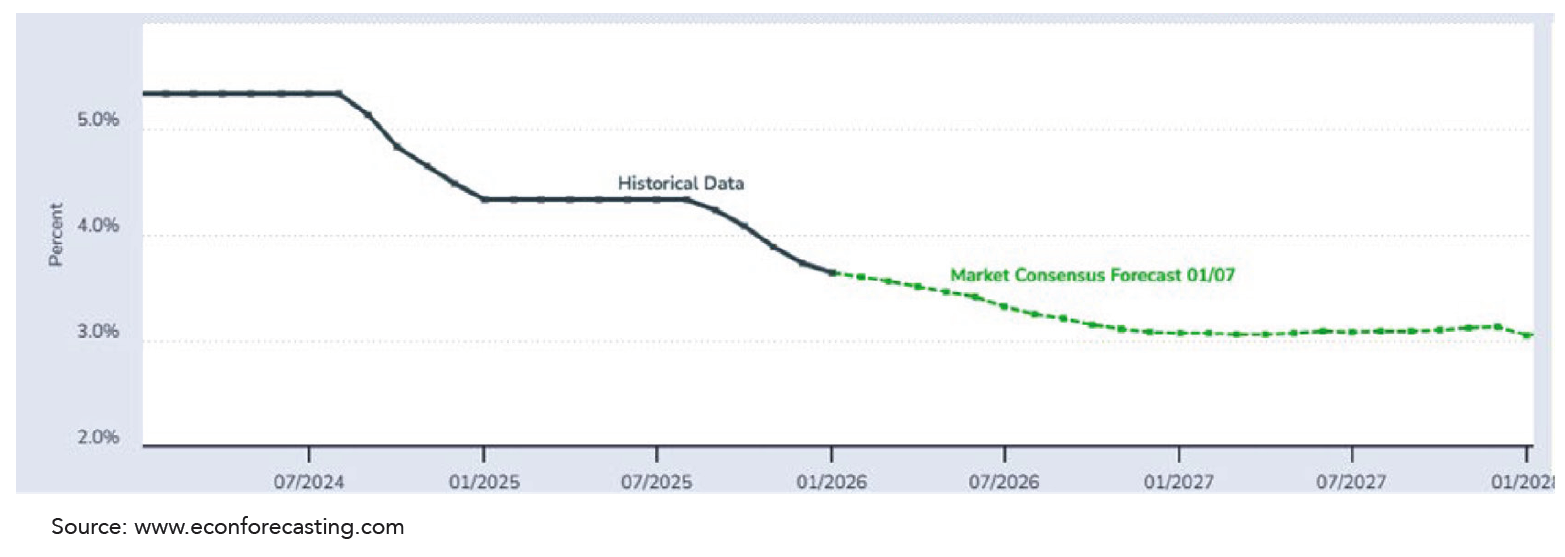

- Positive Federal Reserve moves: rate cut and balance sheet related

- Consumer resilience, despite what seems to be somewhat of a two-tiered environment, as alluded to previously

Again, this is not to say we are without our share of challenges. Rather, it is an attempt to contemplate as full a picture as possible, and a glass that could be half full versus half, or more, empty.

Is The Federal Reserve Saga Nearing a Conclusion?

As has been well publicized, ongoing, broad drama between President Trump and the Federal Reserve, including Chairman Powell, has not completely subsided despite “The Fed” cutting interest rates by .25% in October and December (with some dissents) in addition to the .25% reduction in September. At least at this point, the Fed is not expected to reduce rates in January, although two .25% cuts are currently on the radar in 2026 as it forecasts 2.3% GDP growth, a 2.4% inflation rate and a 4.4% unemployment level.

Federal Funds Rates

The choice of the next Chairman remains front and center, as the leading candidates seem to be National Economic Council Director Kevin Hassett and former Federal Reserve Governor Kevin Warsh. An announcement could be made in January.

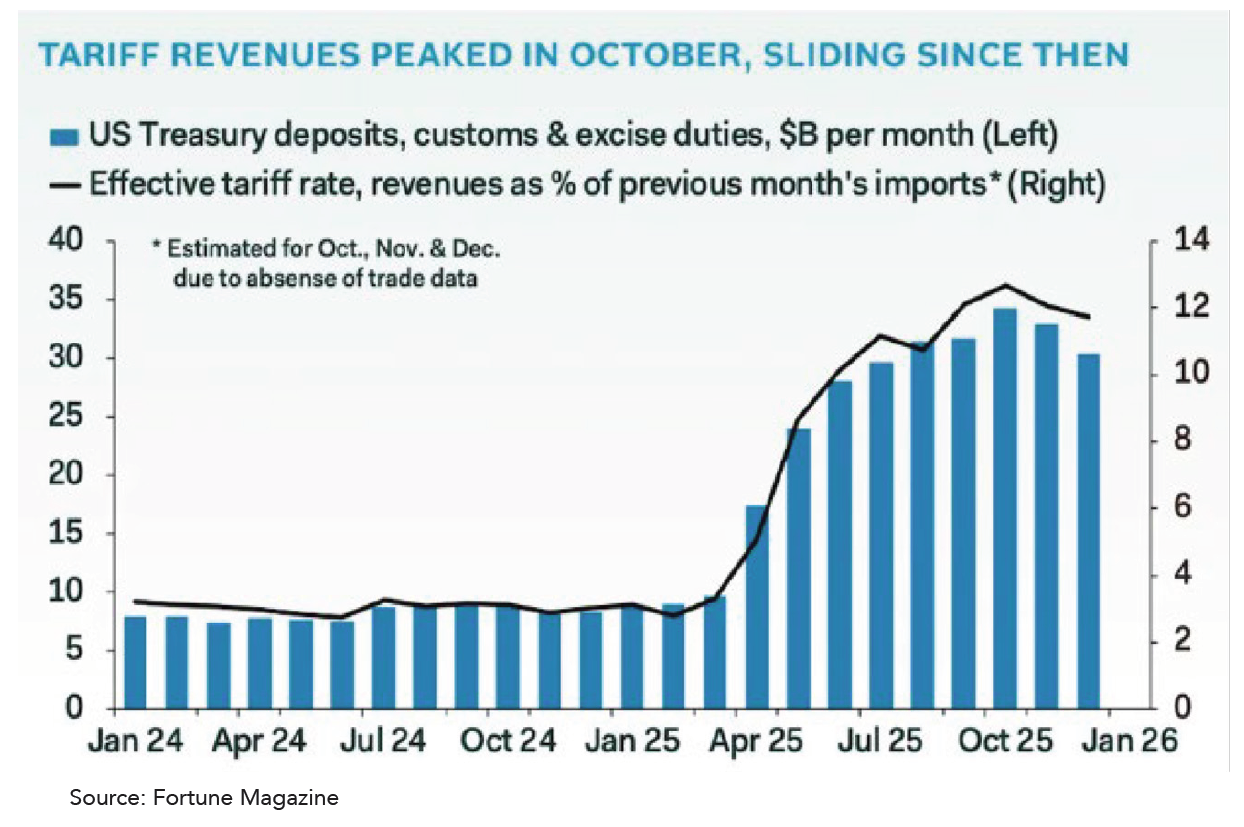

Tariffs

What would a quarterly update in 2025 be without at least a brief discussion of tariffs? As has been well documented, legal challenges to President Trump’s use of executive power to implement tariffs are now in the hands of the Supreme Court. Trade and legal experts see a material probability that during the initial quarter of 2026, the Court will rule against the use of emergency powers (IEEPA) to authorize tariffs. If this indeed ends up being the case, what will be the outcomes? Will the collected tariffs be refunded? If so, what will be the logistics required to do so? Will another tariff mechanism be utilized? Multiple alternative legal authorities are presumably available to the administration to still implement tariffs at present levels. It has been contemplated that a full replacement plan could be put in place to immediately reinstate approximately 80% of tariffs more or less on day one. We shall see, although it seems like a scenario of “how” versus “if”.

Additionally, a couple of other tariff-related dynamics should be noted. First, the moving target(s) associated with implemented levels, including the U.S. and China agreeing to extend a trade truce for a year. Net/net, so far, this has led to a lower level of actual levies than would have been anticipated when originally announced on “Liberation Day” in April. Second, this, along with the Fed rate cuts, resulted in the U.S. Dollar logging its worst year since 2017, particularly versus the Euro.

Venezuela

Although this event occurred post-year-end, it is obviously something of note. Whether it has a material impact on financial markets, positive or negative, is to be seen, as geopolitical situations often have little or none. This being said, it is something to keep abreast of, not only as it plays out in Venezuela itself, but also as it may relate to broader implications in the Western Hemisphere and around the globe.

What Now?!

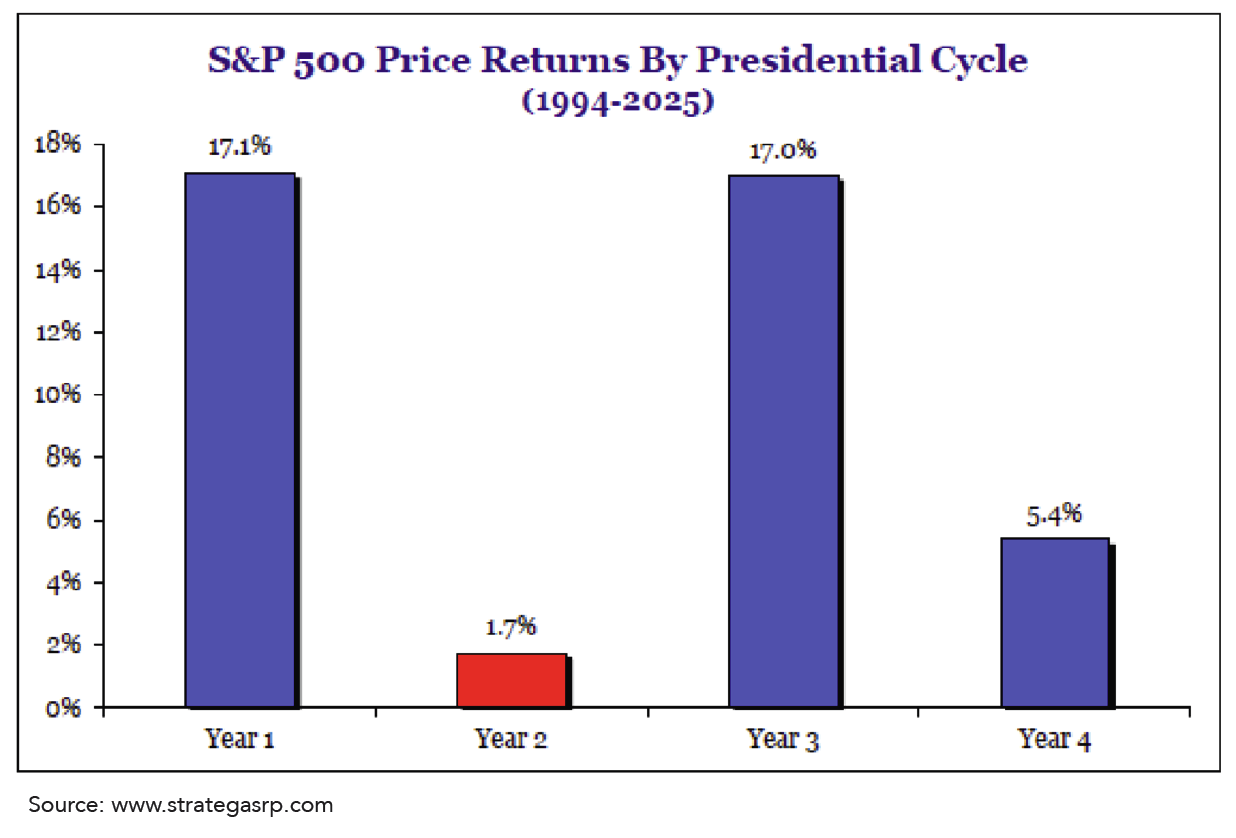

As we enter a mid-term election year (yes, already), it is a good time to at least look at the history that tends to accompany this point in the U.S. election cycle. Despite the second year of a presidential term often having the highest level of economic growth, on average, it is the worst for stocks, which are often good at pricing future growth, but may get jittery once this growth level is perceived to peak. This is not to say we are calling for a material, elongated stock market correction. However, given history and a 23% plus S&P 500 annualized return over the last three years, it would be healthy to at least contemplate that the market could take somewhat of a breather at some point.

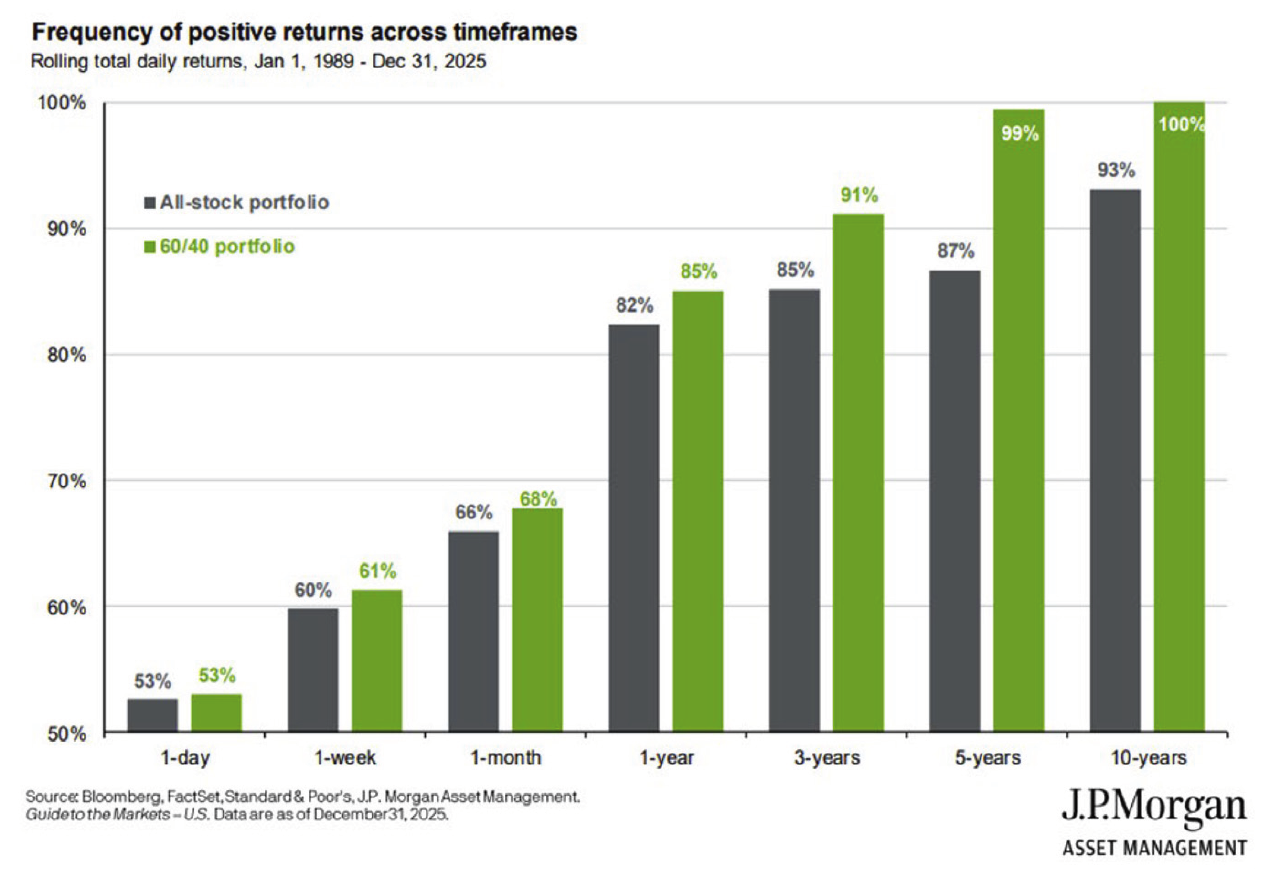

As we have mentioned regularly, patience is a virtue that many of us have difficulty embodying. However, as we have consistently stated, our portfolios are managed with both your risk tolerance and return objective in mind. And we genuinely believe that time in the market is key, as attempting to time the market is a fool’s errand. In our view, compounding returns of high-quality portfolios is key towards achieving your financial goals.

All of us at Country Club Trust Company, a division of FNBO, along with the entire Country Club Bank organization, a division of FNBO, hope that you and your families are well. Please be assured that we continue to work diligently on your behalf, providing the level of service you have come to expect and deserve. As always, we are ready and willing to be of assistance in any way we can. Should you have any questions, we are always here for you.

Take care.