A View From the Tower

A Continuation of Market Strength

As one may well recall, the second quarter, which posted a near 11% S&P 500 return, saw a furious rally post “Liberation Day” as it took just fifty-five trading days for it to roundtrip from its closing low on April 8 to an all-time high on June 30; the fastest bounce back in seventy-five years. The third quarter saw more of the same as the S&P 500 gained an additional 8.1%, on the back of a run of five consecutive monthly gains. Stock strength was relatively broad in nature as depicted within the table above. Of particular note, the Russell 1000 Growth Index rose by 10.5%, continuing its relative strength versus the Russell 1000 Value, which posted a 5.3% return.

Additionally, two areas which have had comparative difficulties for quite some time finally shined as domestic small capitalization stocks soared by over 12% and emerging market equities catapulted by nearly 11%. Not to be left out, the broad bond market extended its rally as the Barclays Intermediate Government/Credit index posted a 1.5% return, reaching 5.7% for the year.

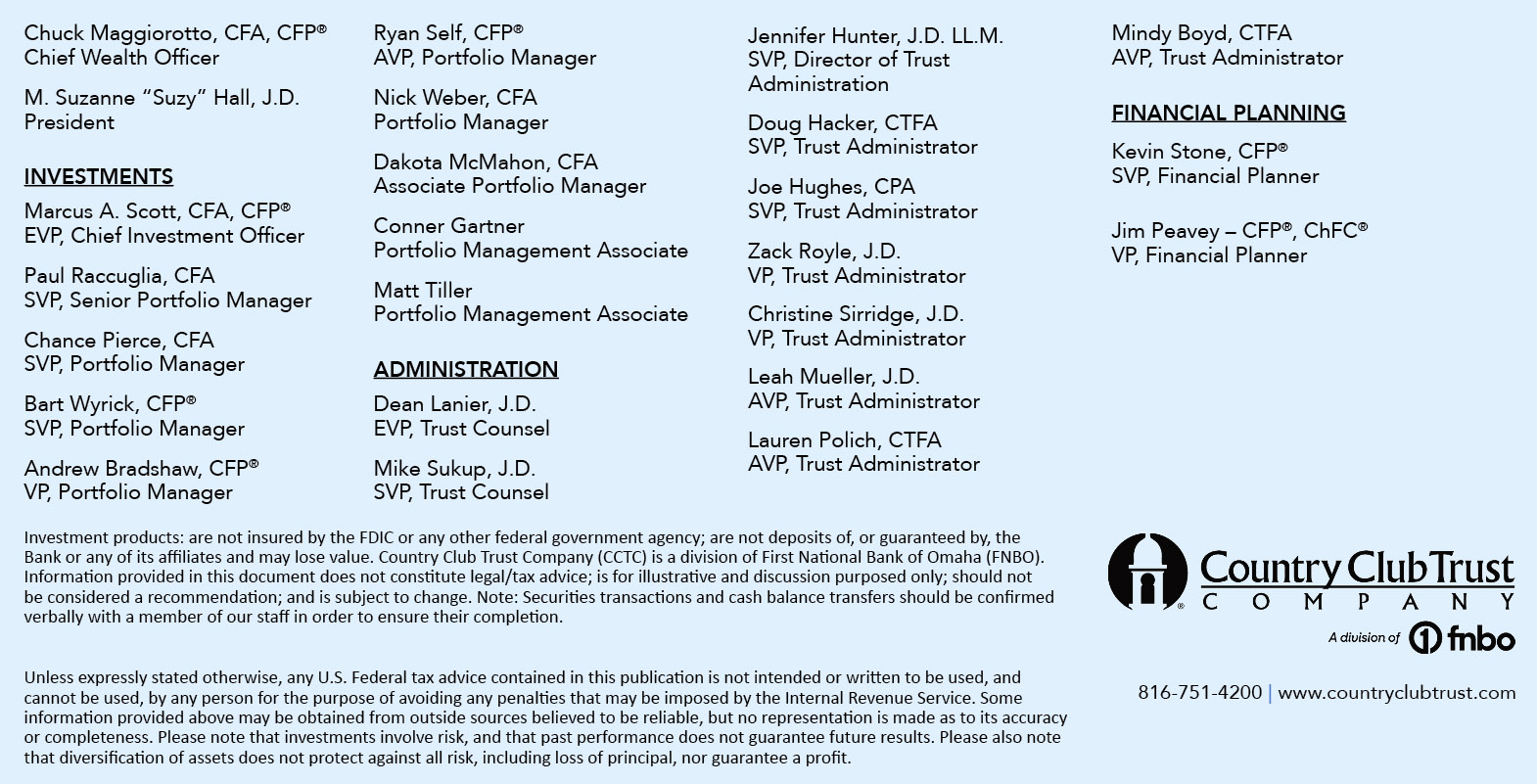

Why did stocks perform so well, with indices hitting multiple record highs during the quarter, even in the face of what some would consider a somewhat uncertain economic environment? Predominantly robust corporate profits. Despite varied inflation data, including ongoing concerns on the tariff front, and a slowing labor market, solid earnings propelled by surging artificial intelligence capital investment spending, led the way forward and upward. Second quarter earnings rose by 11%, exceeding expectations in the 4% range, with the “Magnificent Seven” leading the way. As long as corporate profits year-over-year are in a growth pattern, the economy tends to avoid significant issues. Third quarter earnings are expected to remain strong as well, as prognostications of a 3.8% third quarter Gross Domestic Product (GDP) growth level reflect this. And not to be overlooked, rising asset prices often result in a positive wealth effect, producing a tailwind on the consumer spending front, a key GDP component.

Source: FactSet, Standard & Poor's, J.P. Morgan Asset Management

The Federal Reserve Saga Persists

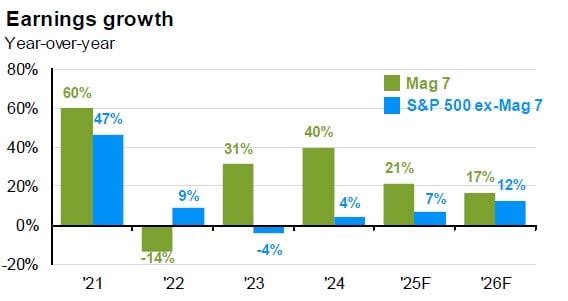

As has been well publicized, ongoing, broad drama between President Trump and the Federal Reserve, including Chairman Powell, did not subside. The President would obviously like “The Fed” to cut interest rates significantly (in addition to the .25% reduction in September) as its preferred inflation gauge, the Personal Consumption Expenditures Price Index (PCE) has at least seemed to calm, coming in at 2.7% for the year ended in August. Although this level is a bit high versus the Fed’s official target, it is not necessarily out of bounds relative to historical data. It also should be noted that as goods inflation (30% of the consumer price index/CPI calculation) has increased, presumably at least partially due to tariffs, housing costs (also a 30% weight) have been softening. As we have mentioned previously, the Fed’s interest rate posture also has an impact on the level of interest expense associated with the growing national debt.

Source: Strategas

What Will the Federal Reserve Do?

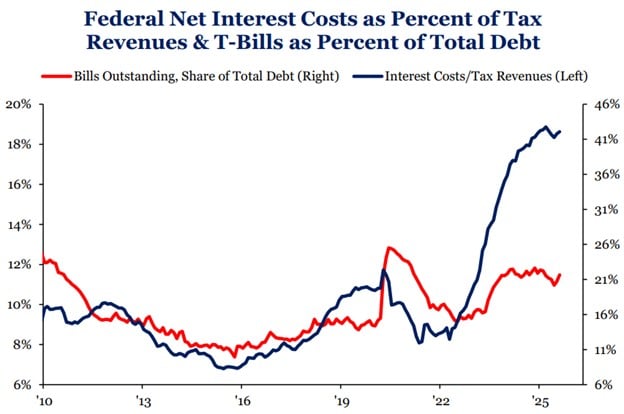

Aside from all the theatrics, eyes remain on the Federal Reserve and what its moves will be during the remainder of 2025 and into 2026. As most may recall, estimates by Fed followers, and by the Fed itself, have not always hit the mark. With the risk of being misguided again, The Fed has continued to project two additional quarter point rate cuts during the remainder of 2025, with meetings in October and December. Additionally, the market is currently anticipating at least one cut in 2026 as the Fed seemingly focuses more on a stalling labor market, on both the hiring and firing fronts, than inflation.

Some might ponder, why would the Fed cut rates with equity markets near all-time highs? And isn’t this unusual? In reality, this dynamic has occurred sixteen times in its history, with the result being a higher S&P 500 a year later each time; with an average return of 15%. Who knows what will occur this time, but most of us would likely be happy with this type of outcome.

Federal Funds Rates

U.S. Government Shutdown Looms

Although likely a surprise to many, over the past thirty years the U.S. Government has shut down for a total of eighty days, none of which associated with a recession by the way. When this circumstance occurs, there tends to be a variety of disinformation around what it actually means and entails. First of all, a shutdown does not actually close all facets of the government, as many elements are exempted, including national security entities and payment offices, like the Social Security Administration. In a nutshell, “essential” areas continue to work while those considered “non-essential” stay home. When a shutdown eventually ends, everyone receives back pay. However, in regard to the current scenario, President Trump is potentially employing a unique approach, telling agencies and departments to make lists of “non-essential” workers who could be furloughed permanently. It is yet to be seen if this is a negotiating ploy or a true threat.

Two things of interest to keep in mind. First, government funding requires 60 votes in the Senate vs. a simple majority; Republicans currently hold 53 seats. Second, historically one of the largest sources of pressure on Congress during these periods tends to come from its own staff not getting paid once the first pay period ends; which happens to be mid-October this go round.

Tariffs

What would a quarterly update in 2025 be without at least a brief discussion of tariffs. As has been well documented, legal challenges to President Trump’s use of executive power to implement tariffs are making their way to the Supreme Court. Trade and legal experts see a material probability that by the first quarter of 2026 that the Court will rule against the use of emergency powers (IEEPA) to authorize tariffs. If this indeed ends up being the case, multiple alternative legal authorities are presumably available to the administration to still implement tariffs at present levels.

What Now?!

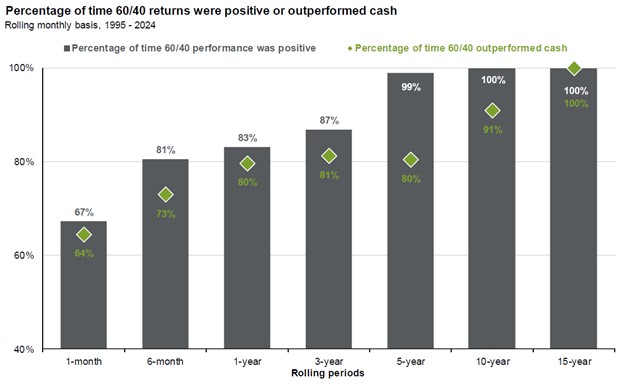

As all of us have been told many times, likely more than we have actually listened to and embodied, patience is a virtue. It’s not always easy admittedly, particularly in an environment of divisiveness. However, as we have regularly stated, our portfolios are managed with both your risk tolerance and return objective in mind. And we genuinely believe that time in the market is key, as attempting to time the market is a fool’s errand. In our view, compounding returns of high-quality portfolios is key towards achieving your financial goals.

Source: Bloomberg, FactSet, Standard & Poor's, J.P. Morgan Asset Management

All of us at Country Club Trust Company along with the entire Country Club Bank organization, a division of FNBO, hope that you and your families are well. Please be assured that we continue to work diligently on your behalf, providing the level of service you have come to expect and deserve. As always, we are ready and willing to be of assistance in any way we can. Should you have any questions, including any related to our recent merger with FNBO, we are always here for you.

Take care.