Debt and Equity Capital Available During the Company Lifecycle

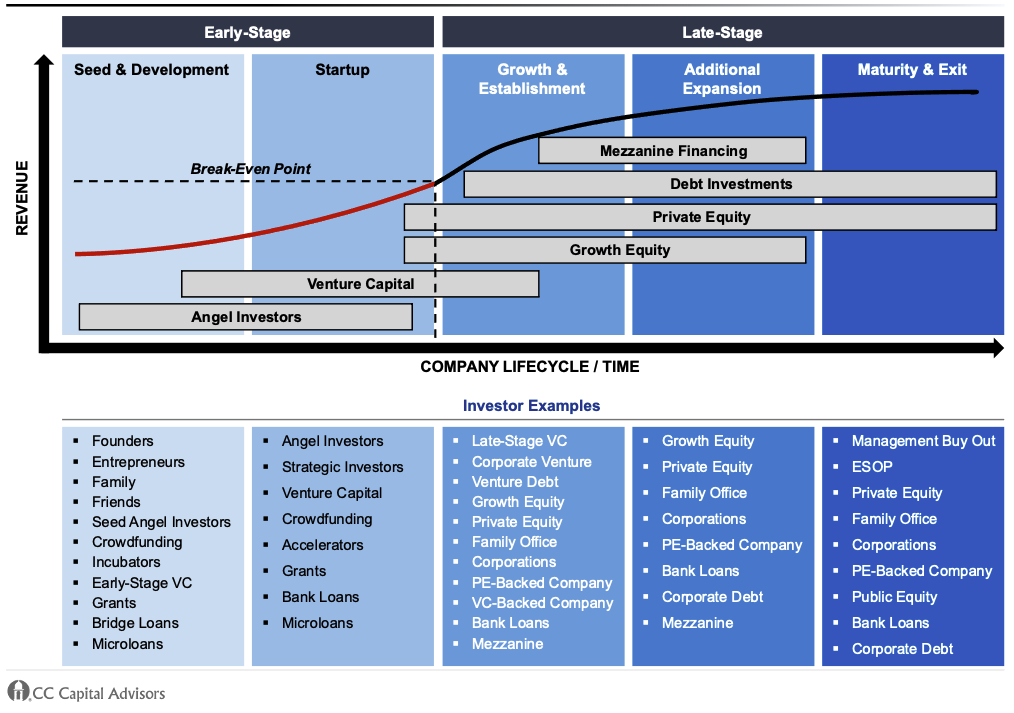

When it comes to the typical lifecycle of a company, one way to view it is through the lens of an investor – in other words, the types of investment capital a company can receive given its lifecycle stage. This capital can take the form of debt or equity, and sometimes a combination of the two. Figure 1 provides an oversimplification of a traditional investment timeline and the types of capital available to a company at a given phase.

Figure 1. Traditional Investment Capital Timeline

We break out the typical company lifecycle into five phases:

Early-Stage

1. Seed and Development

2. Startup

Late-Stage

3. Growth and Establishment

4. Additional Expansion

5. Maturity and Exit

It’s important to note that not all companies follow this exact timeline. Many companies take on little outside capital throughout their lifespans. Revenue also does not typically experience a smooth and constant incline, and mature companies can sometimes see a decline in revenue once they reach that last stage. Nonetheless, Figure 1 helps illustrate the types of capital available to a company depending on where it sits along the spectrum of stages.

It is also worth pointing out there is no set length of time a company should exist in each phase. Companies will move at various paces through the distinct phases. From the perspective of investors, a company’s industry often dictates the ideal amount of time a company will spend in each phase. For example, a seven-year-old software company that is still in the Seed and Development stage could be viewed negatively because they have yet to gain significant traction in the market. A seven-year-old manufacturing company, however, could still be viewed as a relatively young company.

Early-Stage Companies

Figure 2. Early-Stage Companies

As a company begins, the sources of capital are more limited than at any other stage given the heightened risk that comes with a new company. Initial capital often comes from the founders themselves or close friends and family. Once an owner’s personal capital and friends and family routes are exhausted, companies can then turn to either angel investors or early-stage venture capital funds for additional equity raises. Angel investors are often high-net-worth individuals interested in investing in early-stage companies. Angels may also mentor or serve as board members for these startups. However, the most common type of equity investors for early-stage companies are venture capital funds.

Venture capital firms (“VCs”) often raise funds or pool capital sources specifically to invest in companies. Early-stage VCs typically seek a minority interest of 10%-25% of ownership and often have a specific preference for investing at the Seed stage and/or at the Series A or B round.

Series A is often the first institutional funding round of a company. Each subsequent round after a B round, C round, and so on until the company is either acquired or goes public. VC firms will typically have a stated preference for the industry they are interested in, the stage(s) they invest in, and how much they are willing to invest.

Due to the higher risk profile, the capital provider hopes for a big payoff down the road. Because of this, capital providers at this stage will often be equity investors as equity capital has a larger upside than debt capital.

There are some potential debt sources for early-stage companies depending on lending appetite. Debt options are limited, especially via traditional banks, given the lack of collateral in place at a startup company. An early-stage company’s lack of assets, scarce customer base, and limited track record are all items that would qualify as a higher risk profile for lenders.

Early-stage companies can sometimes find alternatives to the lack of debt options available from traditional banks. These nontraditional lending forms are funds that invest solely via debt vehicles. Debt funds are becoming more creative capital paths for early-stage companies. A few examples of debt available to early-stage companies include equipment loans, accounts receivable-based lending, and bridge financing (a short-term loan to “bridge” a company from one capital raise to the next raise). Once again, because this is higher-risk lending, it will come with either a higher interest rate or a convertible equity option to provide additional upside for the lender.

Late-Stage Companies

Figure 3. Late-Stage Companies

Late-stage companies have many more capital options available to them in the form of both equity and debt.

The simpler side is the debt side because both traditional and nontraditional debt options are available for most companies in any of these late stages. Senior debt is typically the most common (i.e., the loan is senior secured, so the lender has the first lien position on the collateralized asset). Additional debt options are available in the form of subordinated, mezzanine debt. This type of debt is usually sought either in conjunction with an equity capital raise or if a company has exhausted its senior debt limit and would rather raise debt than equity. Subordinated debt is as the name implies: It sits under the senior debt lender in terms of claims but would receive payment ahead of any equity holders. Additionally, subordinated debt is typically going to demand a higher interest rate than senior debt to compensate the lender for the additional risk it is taking. Figure 4 illustrates the capital stack of debt and equity options.

Figure 4. Capital Stack Options

When it comes to equity options for late-stage companies, there is still potential for late-stage VC investment for high-growth companies. Late-stage VCs are typically seeking to be one of the last minority equity investments before a company goes public or is sold in an M&A transaction. However, the most common form of equity investment for late-stage companies is from private equity firms (“PEs”). PEs will invest in companies at either a majority or minority equity position. For companies in the Growth and Establishment stage that need capital to execute strategic initiatives, there are PEs that will invest minority capital specifically to fuel growth. Minority equity PEs are also commonly called growth equity investors.

The most common type of PE, however, invests to acquire either a majority or 100% of the equity. Groups that invest a majority typically allow the current owners to retain a minority portion of their equity post-transaction. This allows owners seeking a transaction to receive a sizable portion of their proceeds while also retaining equity for future upside. This can be attractive for owners not quite ready to retire and for a chance at a “second bite of the apple” when they ultimately sell the rest of their equity (hopefully at a higher valuation). Sometimes it makes sense for a PE to acquire 100% of a company’s equity if it aligns with the PE’s stated investment preference or the seller’s desires.

U.S. private equity firms have proliferated immensely over the last decade. So too has the variety of capital needs they fill. As is the case with VCs, PEs will state what their investment preferences are when it comes to size, industry, hold period, types of transactions, etc. they want to participate in.

Conclusion

There is a wide range of capital options available for a company depending on its current lifecycle stage, the goals of the capital needs, and investor appetite. During the last decade, the number of options has grown tremendously as debt and equity investors have become creative with ways to invest in companies across their lifecycle stages. Having trusted advisors to help navigate a company through any form of capital raise is extremely beneficial to maximize the options available.