Factors that Affect Valuation

By: Stephanie Siders

Among the first questions that a business owner asks when beginning to contemplate a sale transaction is around the appropriate EV/EBITDA multiple that can be expected in order to estimate valuation. As M&A advisors, we have a pulse on the market that gives us a sense of general valuation multiple ranges that can be expected for a given industry. Determining where a company’s valuation falls within that range depends on a whole host of factors including company-specific qualitative and quantitative factors and overall industry and market conditions. Below, we break down these categories:

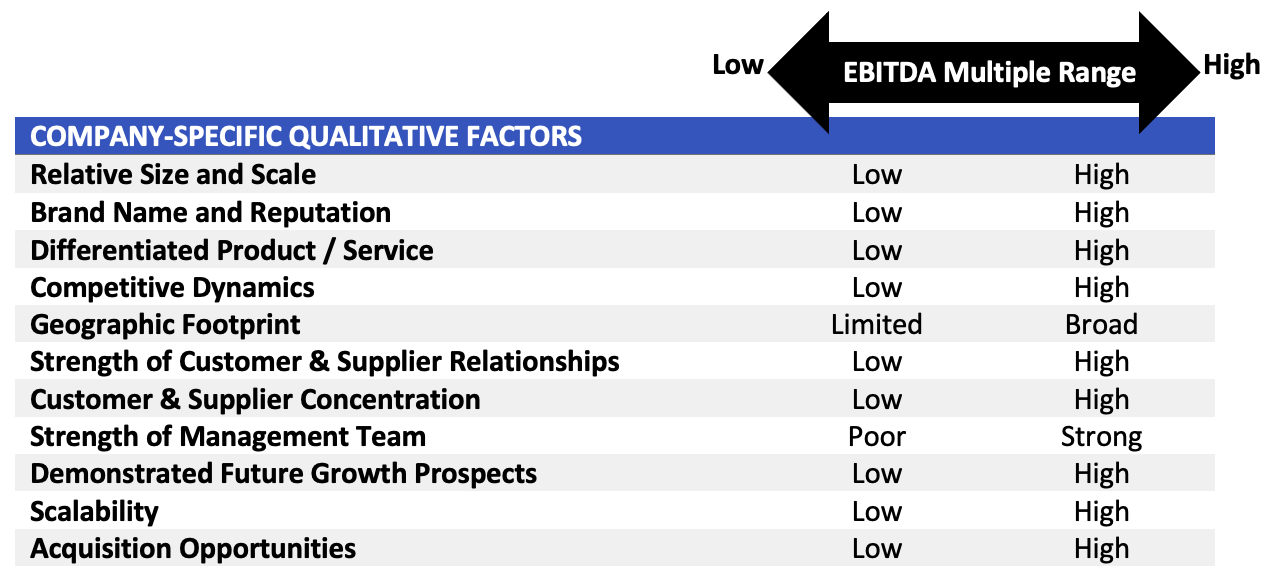

Company-Specific Qualitative Factors

Two companies can operate in the same industry, exhibit comparable revenue and margin profiles, but offer very different value propositions to the market as a function of each company’s qualitative factors such as management team, geographic reach or reputation in the marketplace. The chart below offers a glimpse at how certain qualitative factors can drive a company’s valuation lower or higher. A company that scores high on most or all of these factors will likely achieve a premium valuation in the market.

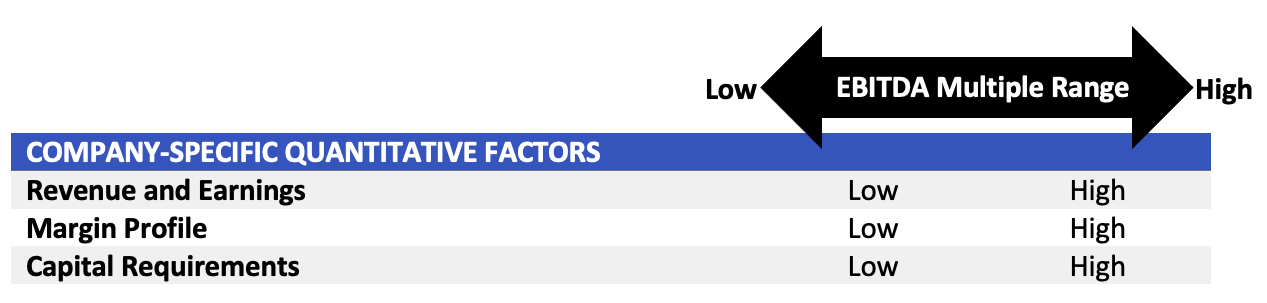

Company-Specific Quantitative Factors

Quantitative factors are the easiest to measure and present. The most critical quantitative factors relate to a company’s ability to generate cash flow.

Let’s dive into each of these factors:

- Revenue and Earnings: Generally, the bigger the company, the higher the multiple. There are certain lower middle market EBITDA thresholds that generate added buyer interest and higher multiples: $2 million, $5 million, $10 million and $15 million. Additionally, if the company has substantial recurring revenue, the dictates a higher multiple.

- Margin Profile: EBITDA margin (EBITDA as a percentage of revenue) can dramatically impact valuation, as it demonstrates an ability to convert revenue into cash flow. Many investors – both financial and strategic – have EBITDA margin thresholds that a potential acquisition must have in order to even be considered. Like the EBITDA thresholds discussed above, there are EBITDA margin thresholds that generate more interest and higher multiples: 10%, 15%, and 20%. A company that produces EBITDA margins greater than 20-25% can expect a significant valuation premium.

- Capital Requirements: A company’s ability to produce free cash flow is not only dependent on earnings, but also the capital expenditures that are required to operate and grow. As an example, a service business has much lower capital needs than a manufacturing company, and as a result, service businesses are valued at a higher multiple, because less cash is required to go back into the business for equipment purchases and maintenance.

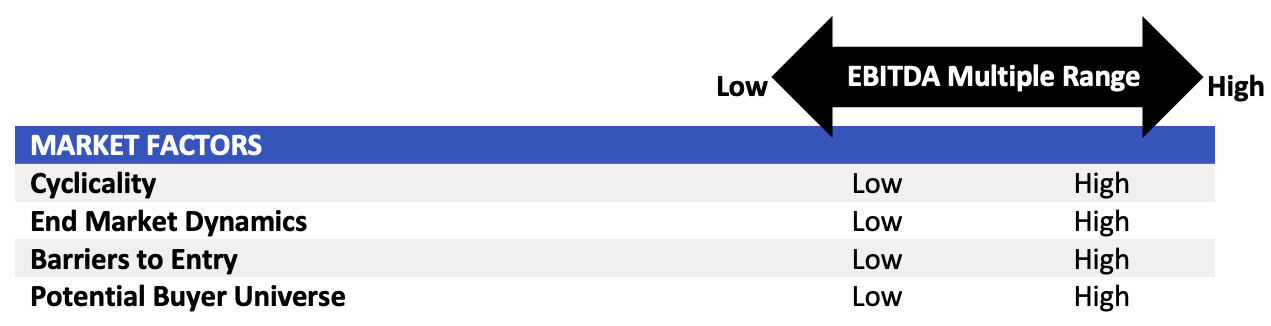

Market Factors

Market factors are at a macro level and tend to be reflective of the industry in which a company operates or even the overall market. While these factors may seem completely out of a business owner’s control, there are ways to mitigate certain risks through diversification of revenue and customer end markets. A few market factors to consider:

Cyclicality, end-market dynamics and barriers to entry may seem obvious, but the potential buyer universe is more difficult to gauge. An investment banker can help you evaluate your company’s industry, review recent transactions and determine activity level relative to other industries, with specific focus on private equity transactions in the space.

Positioning

It is helpful to consider all of these factors well in advance and determine where your company falls on the spectrum for each. There may be certain measures that can be taken proactively to increase valuation. Are there weaknesses in your management team that can be addressed? Are there opportunities to cut overhead expenses which would increase EBITDA margin? Can your sales team focus on customers in end markets that would provide more diversification and less cyclicality?

When it comes time to start the transaction process, an advisor will evaluate your company and determine how to best position its strengths and weaknesses. When the company is marketed to potential buyers, emphasis on the characteristics that drive a higher valuation are key to a successful outcome.