The Evolution of Sell-Side M&A

By: Stephanie Siders

Our firm has decades of experience advising middle market M&A transactions, and while the basic process of executing a deal has remained the same, there have been changes in the market that have dramatically changed how we execute. Following several years of heightened deal activity, it’s worth reflecting on how the M&A world - specifically in the lower middle market - has evolved over the last couple of decades and how that evolution has impacted outcomes.

Proliferation of Financial Investors

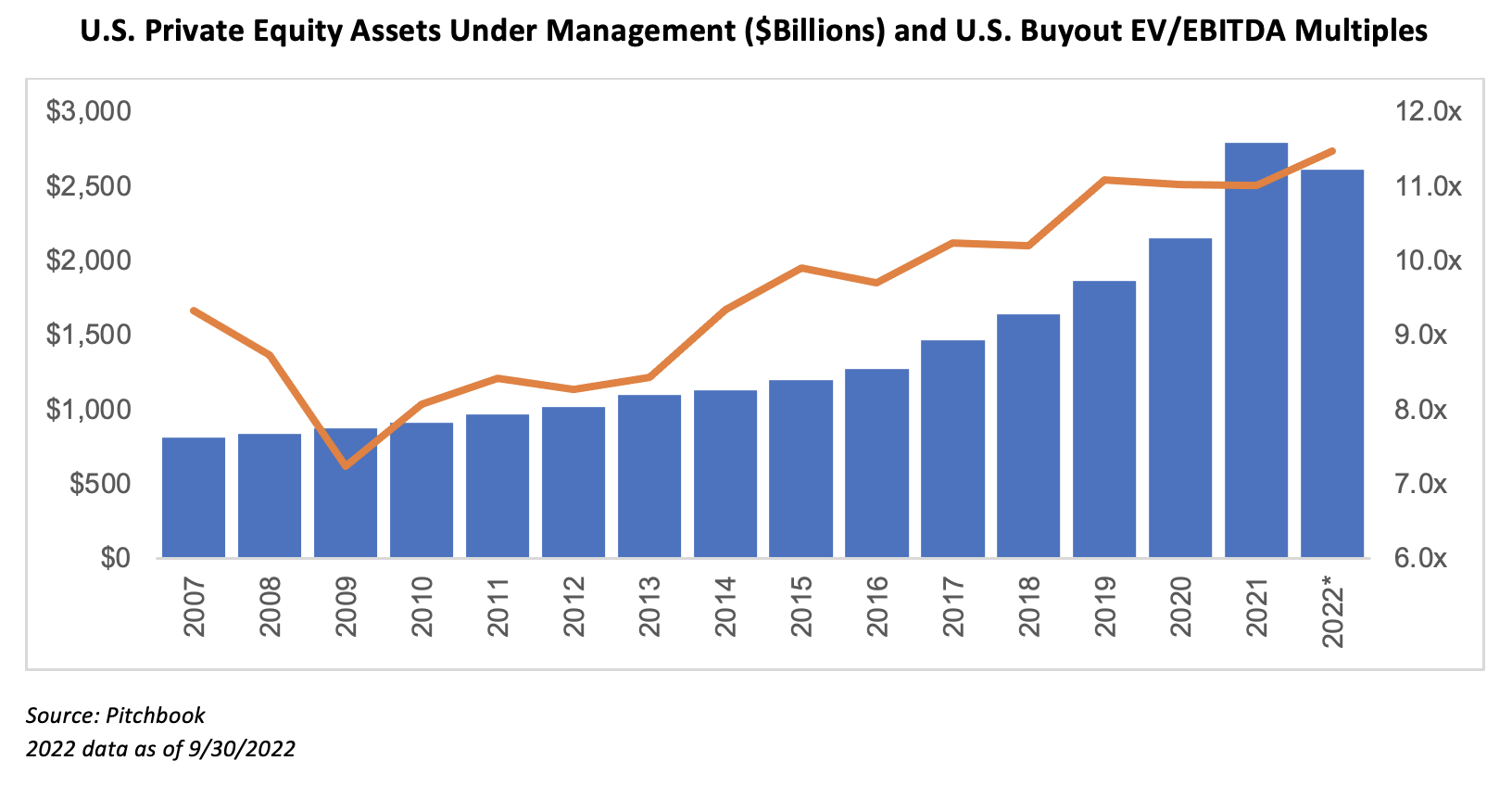

Increased availability of capital from the private markets has had a profound impact on both the demand for acquisitions as well as valuations. As the popularity of taking lower middle market companies public waned in the 1990’s and early 2000’s, private capital providers filled the void. Since 2005, assets under management for private equity in the U.S. has grown by over 5x as a result of an increase in number of firms and fund sizes.

Fifteen years ago, we may have reached out to 30-50 financial buyers on a typical sell-side transaction. Today, it’s difficult to narrow down to less than 100, and many of the strategic buyers we identify are already backed by private equity. We approach more private equity buyers for a couple reasons: 1. There are more firms for which any given company fits the stated investment criteria. 2. Unlike strategic buyers, who are more opportunistic with acquisitions, private equity firms typically have limited partners (investors) that have committed capital to the fund to invest, requiring investment in order to keep the committed capital. The heightened competition from the increase in capital providers has resulted in more transactions executed at higher valuations.

Furthermore, in decades past a typical investment exit for a lower middle market private equity firm would have likely been to a strategic buyer, but today the acquirer of a PE-backed company is more than likely a larger private equity firm.

Roll-up Strategies

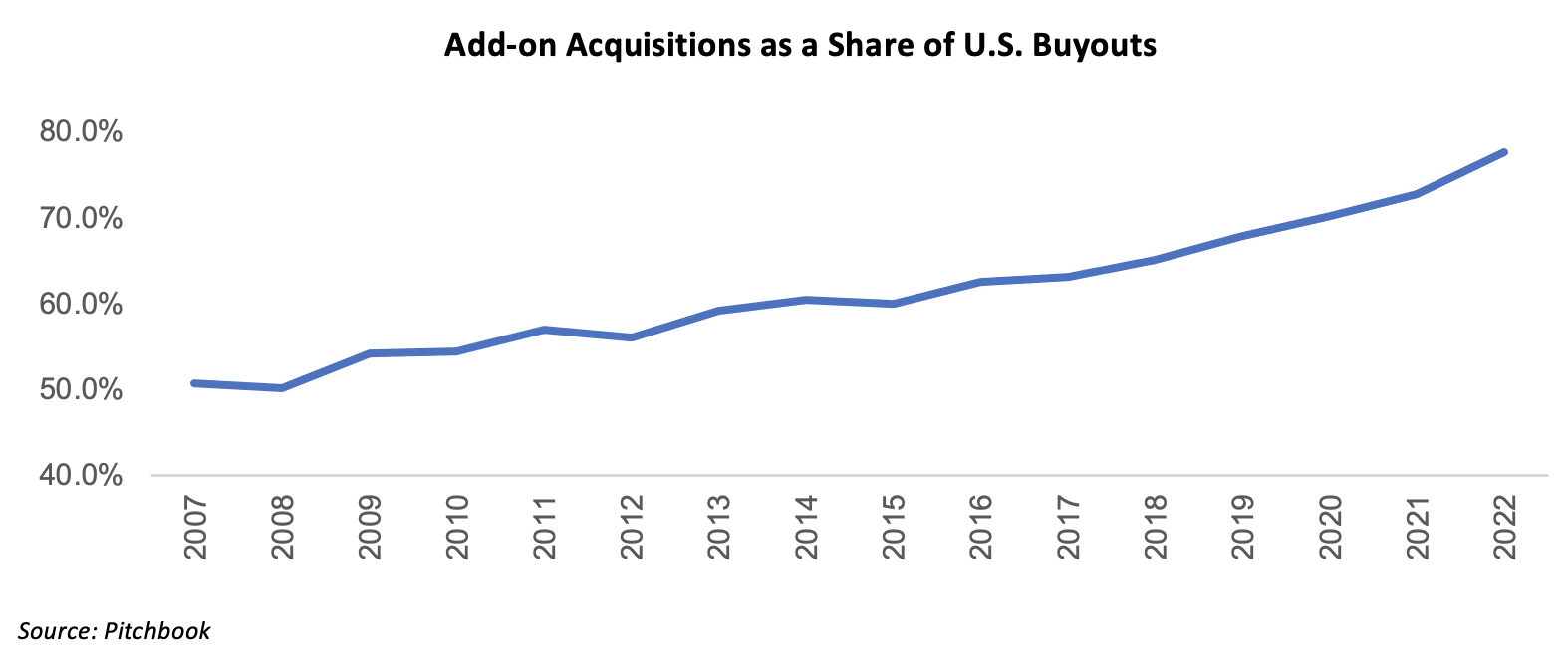

As the number of private equity firms and size of funds has increased, financial buyer strategies have evolved. The prototypical private equity strategy from 20 years ago included acquiring a company, drastically cutting overhead costs while growing revenue, then selling it or taking it public. Today, most middle market firms have shifted to a rollup strategy, which includes buying a company (the “platform”) then acquiring smaller companies that are in the same industry as the platform (the “add-on acquisitions”) to form a larger entity. The add-on acquisitions are frequently acquired at a lower multiple, then when the private equity firm sells the combined entity to a larger private equity firm or corporate buyer, it is sold at a higher multiple, which is termed “multiple expansion.” According to Pitchbook, over 75% of buyouts in the U.S. were add-on acquisitions in 2022, a 25% increase compared to fifteen years ago.

To illustrate, a platform company is acquired at a valuation of 8x the company’s last twelve months’ EBITDA of $5 million. The firm makes two subsequent add-on acquisitions of companies that each have approximately $3 million of EBITDA, both valued at 6x EBITDA. Thus, the aggregate investment in the three companies (the initial platform plus two add-ons) is $76 million. After four years and an average annual EBITDA growth of 10%, the company has now achieved $16 million of EBITDA and is sold for 12x EBITDA or $192 million, generating a significant gain for investors. As we explained in our post “How EBITDA Affects Valuation”, as a company hits greater EBITDA thresholds, the multiples increase, thus achieving multiple expansion.

Data Availability

In the early days of the internet and before, potential buyers your banker personally knew was critical for successful M&A transactions. Information, especially regarding privately held businesses, was difficult to find giving large investment banks a distinct advantage. Today, rolodexes (in both the literal and figurative sense), while still important for gathering industry and deal-specific intelligence, are less relevant for identifying buyers. Unprecedented access to data helps investment bankers provide well-informed valuation guidance and identify buyers and contact information in a more efficient way than ever before. Some data comes at a steep cost, but through subscriptions, news sources, and companies’ websites, we are able to advise clients and create buyers lists with confidence that we have all available information. A level playing field has emerged as lower middle market firms have access to the same information as large Wall Street firms. As sell-side M&A advisors, we are always in pursuit of the potential buyer that could offer the “spike bid” that exceeds what most other buyers are willing to pay. Enhanced information has enabled us to more easily identify these buyers and get the best value for our clients.

There is, however, one glaring data limitation: private company data. Most private companies and private buyers do not release transaction information, limiting the availability of multiples data for M&A transactions.

Technology Efficiencies

Advancing technology has had a significant impact on how transactions are executed. Virtual meeting capabilities enable us to more frequently meet with our clients and share information with them from afar as we help guide through a transaction process. In the past three years, pandemic challenges forced us to hold virtual management presentations and even virtual facility tours. Our preference is always in-person meetings for those types of critical events, but when in-person isn’t possible we have options available to keep a process moving. Additionally, virtual data rooms allow us to easily and safely share information, and CRMs allow us to track transaction activities and counterparties, enabling us to effectively collaborate and work more efficiently as a team compared to the days of inputting call notes into a shared spreadsheet. Overall, technology has made processes more efficient and improved certainty to close, which is good for buyers and sellers alike.

Where Do We Go from Here?

We see the trends over the last twenty years continuing: more private capital, more private equity backed companies looking for acquisitions, and more technology. AI solutions in particular are bound to cause further shakeups as they become prevalent in the M&A market. As the market continues to become more competitive for acquisitions and buyers approach acquisition targets directly, it will become increasingly important to have an advisor to guide and negotiate through a process.