A View from the Tower - First Quarter, 2023

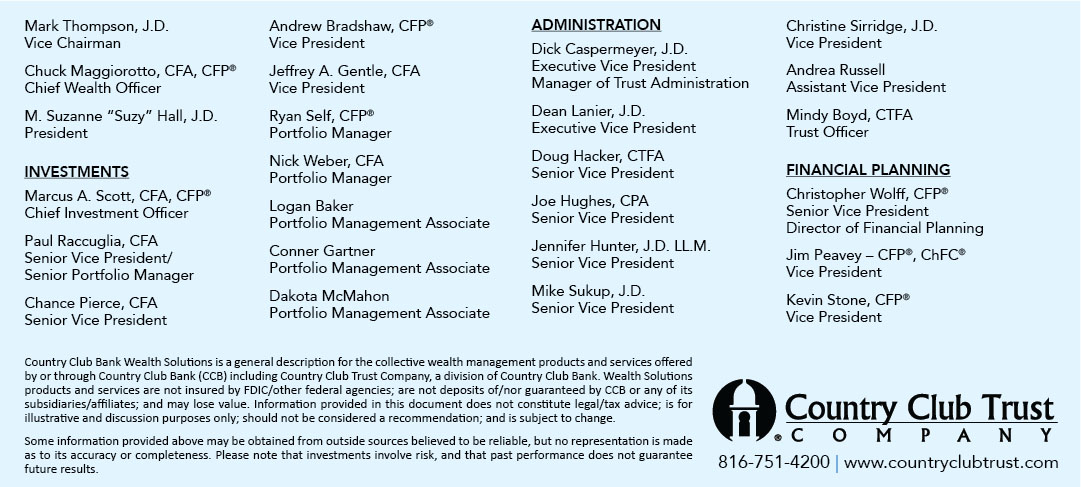

There is an old saying that the Federal Reserve raises rates until something breaks and break it did. Interestingly to some, the Fed subsequently raised rates again. In addition, futures markets are telling us that there is greater than a 50/50 chance that another hike is coming in May. We will see. Milton Friedman is often quoted as saying “Monetary actions affect economic conditions only after a lag that is both long and variable.” This long and variable lag is often thought of in economic circles to be 12-18 months. And, wouldn’t you know it, we may be seeing some subtle signs that past rate hikes are starting to have their intended effect. Right on time! The current hiking cycle began on March 16, 2022.

We aren’t short of material to write about. As usual, there was plenty of news during the quarter. Incoming data is always abundant. Markets gave both the bulls and the bears plenty to think about. We heard about a hard landing, a soft landing, and finally, a no landing. The Fed met two times, raising rates in both instances, and providing additional fodder for recession calls. Inflation was sticky, of course, but we remain optimistic that we are headed in the right direction. The employment picture remained strong, but we see cracks potentially forming.

What Worked and What Didn’t

The S&P 500 finished up 7.5% in the first quarter, driven mostly by growth stocks. The Russell 1000 value returned just 1.0%, while the Russell 1000 growth was up 14.4%. Growth was up, in part, due to the benefit of falling interest rates. But we can’t ignore the quality factor. Growth names that drove equity markets during the quarter tended to be large capitalization, high free-cash flow producers with low liquidity needs. In other words, they tend to be self-financing enterprises with limited use of outside capital provided by debt and/or equity markets. We can see this by examining returns of smaller companies, like those that make up the Russell 2000 growth index. This index returned 6.1% in the first quarter, 8.3 percentage points less than its large-cap cousin, the Russell 1000 growth Index. The top sectors in the quarter were technology, communication services and consumer discretionary.

International stocks traded in-line with domestic markets, with emerging markets trailing developed. The MSCI All Country World Index ex. U.S. was up 7.0% for the quarter, while the MSCI Emerging Market Index rose 4.0%. Again, the quality factor was at work.

Domestic bonds rallied into the end of the March quarter, driven by lower Treasury yields. Longer maturity bonds benefited the most, as the Treasury market began pricing in slower growth/inflation ahead. 30-year Treasuries returned 6.0% during the quarter, while the 10-year total return was 3.8%. Corporate bonds, as represented by the Bloomberg Barclays U.S. Corporate Index, were up 3.5% in the quarter.

Fed May be Done

The Fed held meetings in both January and March, raising the Fed Funds rate by 0.25 percentage points at each. This was the ninth consecutive hike over the past year and has raised the effective Fed Funds rate by approximately 4.5 percentage points. The purpose of the raises, of course, is to slow the economy and stomp out the inflationary impulse we have experienced as a result of pandemic era fiscal and monetary stimulus. Higher interest rates work by making credit more expensive, raising the cost of capital used to finance a new car, a new home, business expansion, etc. Fed Funds futures are currently projecting an additional .25 percentage point hike at the May meeting but also a possible cut by September.

Four times a year, the Federal Reserve releases a summary of Federal Open Market Committee (FOMC) participants’ projections for GDP growth, the unemployment rate, inflation, and the appropriate policy interest rate. These projections typically don’t change much with each new release. And, after all, they are modeled estimates of an extremely complex economy. Take them for what they are. However, we believe the timing and estimates of the most recent projections, released March 22, seem to be pointing to a Fed view that a recession is imminent. Interestingly, the most recent median projection for 2023 real GDP growth is 0.4%, while the projection for the year-end unemployment rate is 4.5%. At the time of release, the Atlanta Fed’s model, GDPNow, was projecting first quarter 2023 real GDP growth of 3.5% and an unemployment rate of 3.6%. The math doesn’t work unless aneconomic contraction occurs in 2023.

Four times a year, the Federal Reserve releases a summary of Federal Open Market Committee (FOMC) participants’ projections for GDP growth, the unemployment rate, inflation, and the appropriate policy interest rate. These projections typically don’t change much with each new release. And, after all, they are modeled estimates of an extremely complex economy. Take them for what they are. However, we believe the timing and estimates of the most recent projections, released March 22, seem to be pointing to a Fed view that a recession is imminent. Interestingly, the most recent median projection for 2023 real GDP growth is 0.4%, while the projection for the year-end unemployment rate is 4.5%. At the time of release, the Atlanta Fed’s model, GDPNow, was projecting first quarter 2023 real GDP growth of 3.5% and an unemployment rate of 3.6%. The math doesn’t work unless aneconomic contraction occurs in 2023.

Hike Until Something Breaks

The FDIC seized control of regional bank, Silicon Valley Bank, on March 10, after a run on deposits left it insolvent. While it appears the bank failure was mostly idiosyncratic in nature, due to an outsized duration mismatch between its assets/liabilities and an extremely high concentration of technology related companies as its customers, both equity and bond investors reacted quickly to shed risk and seek safe-haven investments. The S&P 500 was down 3.4% in the days surrounding the event. It’s large-cap constituents and diversification handled the shock fairly well. However, the small- bank heavy Russell 2000 was off 7.2% and the SPDR S&P Regional Banking ETF (KRE) was down 23.8%.

The FDIC seized control of regional bank, Silicon Valley Bank, on March 10, after a run on deposits left it insolvent. While it appears the bank failure was mostly idiosyncratic in nature, due to an outsized duration mismatch between its assets/liabilities and an extremely high concentration of technology related companies as its customers, both equity and bond investors reacted quickly to shed risk and seek safe-haven investments. The S&P 500 was down 3.4% in the days surrounding the event. It’s large-cap constituents and diversification handled the shock fairly well. However, the small- bank heavy Russell 2000 was off 7.2% and the SPDR S&P Regional Banking ETF (KRE) was down 23.8%.

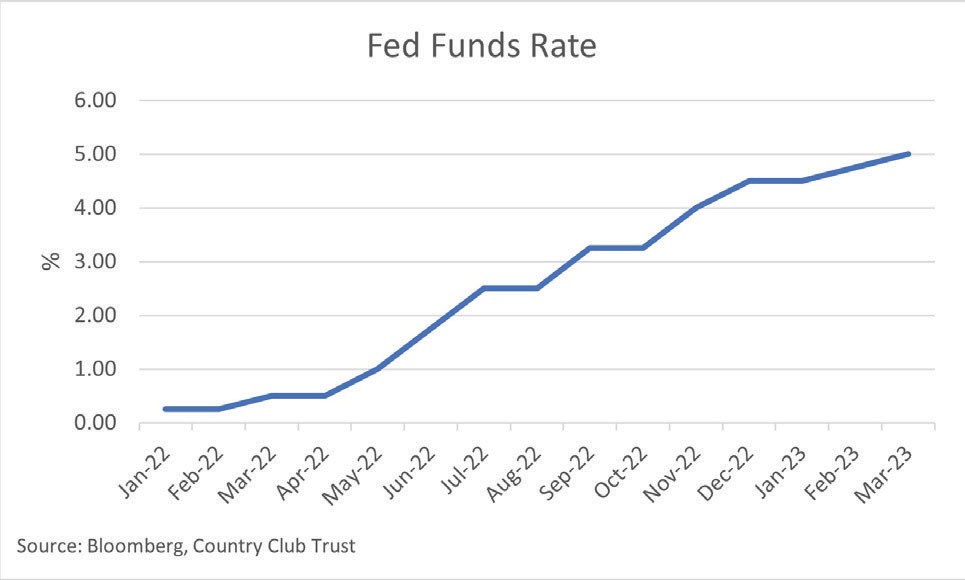

If volatility in the equity market didn’t cause concern, moves in the Treasury yield curve made investors take notice. Bond investors viewed the event as highly contractionary in nature. Yields on the 2-year Treasury, which market prognosticators look at to gauge the direction of the economy, were down 0.89 percentage points in only 2-days of trading. The bond market seems to be projecting that both the Fed Funds rate and economic growth (inflation), will come in lower than previously thought due to further contraction in the availability of credit. We tend to agree.

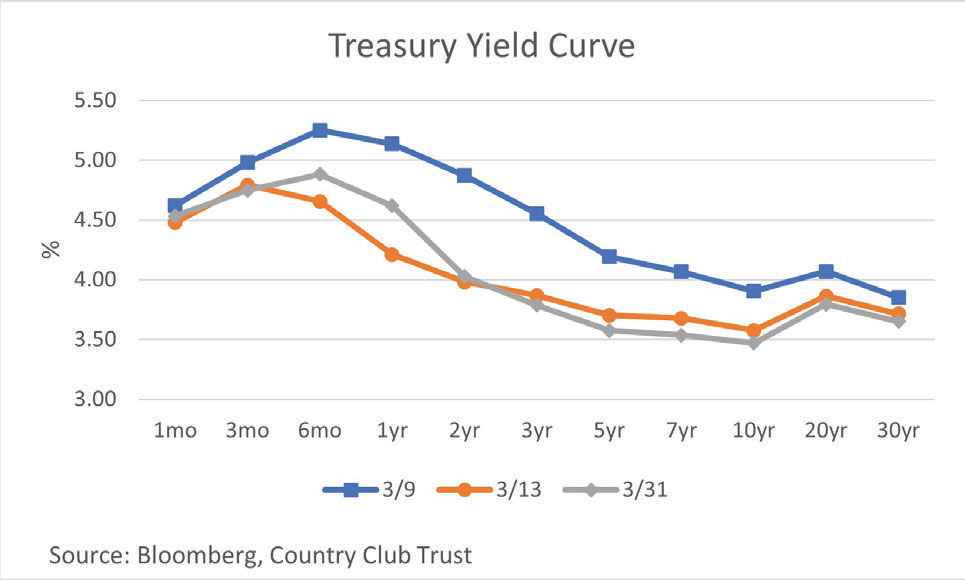

Credit Contraction

The quarterly Senior Loan Officer Survey is a good gauge of perceived credit risk by banks. As we look at the net percentage of banks tightening lending standards, we see that loan officers’ overall appetite for additional credit risk is low. We believe the next survey, to be released in May, will show further contraction in the availability of credit. As mentioned previously, higher

The quarterly Senior Loan Officer Survey is a good gauge of perceived credit risk by banks. As we look at the net percentage of banks tightening lending standards, we see that loan officers’ overall appetite for additional credit risk is low. We believe the next survey, to be released in May, will show further contraction in the availability of credit. As mentioned previously, higher

interest rates affect the demand-side for credit. Tighter loan standards affect the supply-side. Typically, these supply/demand dynamics work hand-in-hand in slowing the economy and lowering inflation. Tightening lending standards could decrease the need for additional interest rate increases.

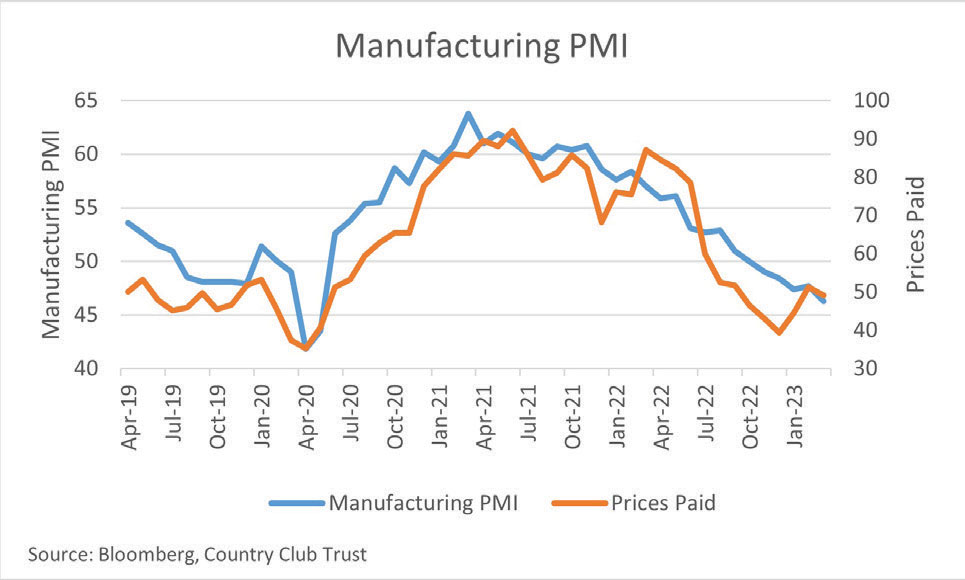

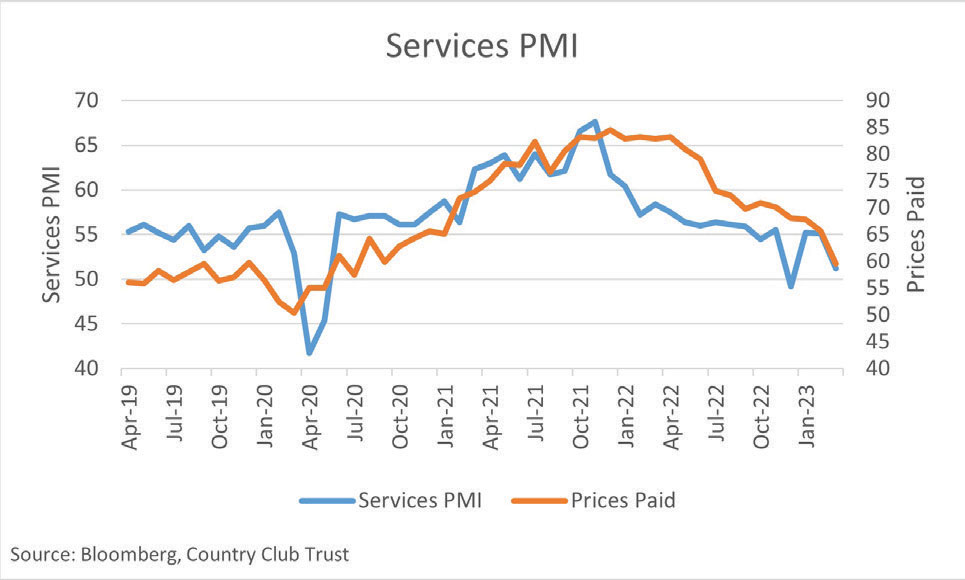

ISM PMI’s – Output Trending Down in Manufacturing, Not in the Service Economy

About the closest thing we can get to real time information on the state of the economy comes from the Institute for Supply Managements (ISM) monthly survey of purchasing managers. In the survey, the ISM asks if variables related to business activity are expanding or contracting. A reading above 50 suggests that variable is expanding, while a reading below 50 suggests contraction.

About the closest thing we can get to real time information on the state of the economy comes from the Institute for Supply Managements (ISM) monthly survey of purchasing managers. In the survey, the ISM asks if variables related to business activity are expanding or contracting. A reading above 50 suggests that variable is expanding, while a reading below 50 suggests contraction.

During the month of March, Manufacturing PMI’s continued to contract, showing a reading of 46.3. In fact, they have been contracting since November of 2022. Importantly, March was the first month in which all the variables in the survey were at levels below 50 in this business cycle. Although the manufacturing sector has been in contraction for several months, that data point does not necessarily mean we are on the verge of a recession. Quite often, the manufacturing sector contracts while the service sector continues to drive growth. The service sector represents approximately 80% of the U.S. economy.

Case in point, the services PMI continues to expand, albeit at less aggressive rates than the recent past. The services PMI peaked in November of 2021 at 67.6, and has fallen to a reading of 51.2 in March. Increased interest rates are definitely having an impact on services PMI components. The largest constituent of the services PMI (real estate, rental and leasing), making up almost 14% of GDP, was listed as the component having the largest decrease in new order activity.

Case in point, the services PMI continues to expand, albeit at less aggressive rates than the recent past. The services PMI peaked in November of 2021 at 67.6, and has fallen to a reading of 51.2 in March. Increased interest rates are definitely having an impact on services PMI components. The largest constituent of the services PMI (real estate, rental and leasing), making up almost 14% of GDP, was listed as the component having the largest decrease in new order activity.

Markets are closely watching the prices paid component of the PMI surveys, as indicators of future rate hikes by the Fed. March presented us with a mixed bag of news. In the manufacturing sector, the prices paid figure dropped about 2%, to 49.2, from a reading of 51.3 in February. This suggests prices are fairly sticky. The prices paid component has been in a range of 52.5 to 39.4 since August, 2022. The March services price index figure, which economists view as a sign of consumer spending inflation, came in at 59.5. This suggested a fever break after 29 consecutive months of readings north of 60. We saw 10 months above 80 and an all time high of 84.5 in December of 2021. Prices paid have dropped rapidly, but are still at worrisome levels for the Fed.

The Really Important Stuff – Employment

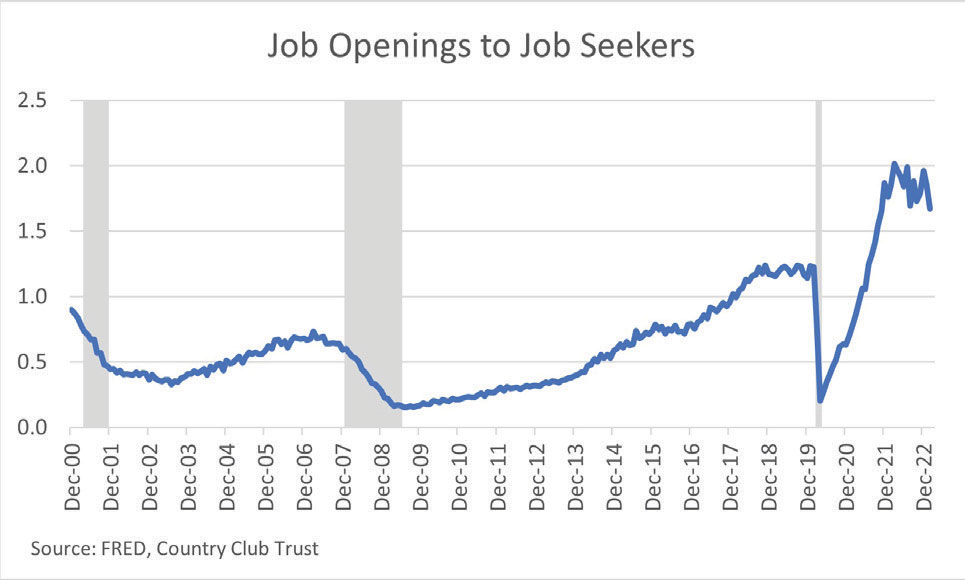

If you really want to know the state of the economy, look no further than the labor market. Expansion in employment leads to increased national income and most likely, increased spending. The labor market has been incredibly resilient, post the pandemic shut-down.

If you really want to know the state of the economy, look no further than the labor market. Expansion in employment leads to increased national income and most likely, increased spending. The labor market has been incredibly resilient, post the pandemic shut-down.

The Job Openings and Labor Turnover Survey (JOLTS) can be a useful indicator of where the labor market is heading. The February report showed total private job openings were down 599,000 from January, though still at a healthy level from a historical perspective. The greatest number of openings continue to be found in service industries such as professional and business services, health care and social assistance, accommodation and food services, and retail trade. These industries accounted for 63% of non-government job openings. Importantly, the number of openings in these service industries fell by 625,000 from January levels. These industries have been important drivers of labor demand since pandamic lock-downs began to fade, and may be an indicator that the red-hot labor market is starting to crack. In the past, a downturn in the job openings to unemployed has been a useful indicator of a pending downturn in the economy.

In Summary

We believe rate increases are beginning to bite the economy and will work to drive inflation down to sustainable levels. We saw signs of this emerge in data collected before recent bank struggles. Keep in mind, we have only recently begun to feel the effects of past rate hikes, and they will continue to filter their way through the economy. We also believe that the availability of credit will continue to decline as banks preserve capital. The result, we believe, is economic contraction as we move into the back-half of 2023. It is important to note that this is our belief, and not a certainty. Events could play out to form a different outcome, and we must be prepared for that as well.

Our portfolios are managed with both your risk tolerance and return objective in mind. We truly believe that time in the market is key, and attempting to time the market is a fool’s errand. In our view, compounding returns of high-quality portfolios is key towards achieving your financial goals.

All of us at Country Club Trust Company, along with the entire Country Club Bank organization, hope that you and your families are well. Please be assured that we continue to work diligently on your behalf, providing the level of service you have come to expect and deserve. As always, we are ready and willing to be of assistance in any way we can. Should you have any questions, we are always here for you.

Take care.