Coming Attraction: Supersize 401(k) Contributions

For those who failed to save for their retirement early in their careers, the tax code has long permitted age-based “catch-up” contributions to IRAs and 401(k). The SECURE Act 2.0 established an even bigger 401(k) catch-up for those who are 60, 61, 62, and 63, a bonus contribution of $3,750. The change takes effect in 2025.

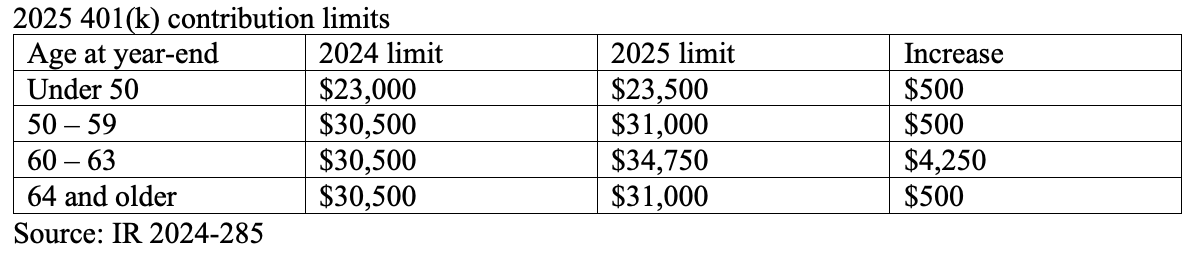

The table below shows the age-based 401(k) contribution limits for 2025 after inflation is taken into account.

The supersized limit does not apply to IRAs. The 2025 limit for deductible IRA contributions will be $7,000, with a catch-up allowance of $1,000 for taxpayers 50 and older. The IRA catch-up will be indexed for inflation in the future.

Although the added incentive to boost savings just before retirement begins is welcome, it’s not something to rely upon. Putting more money into a 401(k) plan early in one’s career, starting in one’s 30s or ever 40s, will do far more for retirement security than larger contributions late in the earning years. Earlier contributions have the benefit of many more years of compounding growth.

(November 2024)

© 2024 M.A. Co. All rights reserved.

Some information provided in the Knowledge Center may be obtained from outside sources believed to be reliable, but no representation is made as to its accuracy or completeness. This information is intended for discussion purposes only and should not be considered a recommendation. The information contained herein does not constitute legal, tax or investment advice by Country Club Trust Company. For legal, tax or investment advice, the services of a competent professional person or professional organization should be sought. Trust services and investments are not FDIC insured, are not guaranteed by the Trust Company or any Trust Company affiliate, and may lose value. Past performance is no guarantee of future results.