How to Handle an Inherited IRA

Once upon a time, distributions from an inherited IRA could be spread over the beneficiary’s lifetime. For young beneficiaries, the RMDs might be small enough that the inherited IRA would continue to grow handsomely. This changed with passage of the SECURE Act in 2019.

In general, an inherited IRA will have to be distributed by the end of the tax year that includes the tenth anniversary of the owner’s death. That works out to 11 tax years for receiving and reporting the IRA distributions. Subject to one critical caveat explained below, there is no requirement for annual distributions during the ten years—they may be front loaded, back loaded, or paid roughly equally over the period, which should provide the greatest tax efficiency.

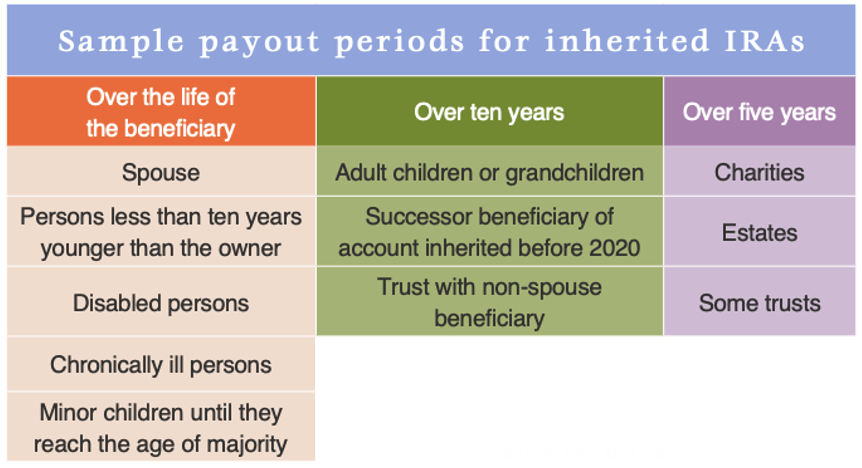

Only “eligible designated beneficiaries,” as defined in the new law, are allowed to stretch the IRA payouts over their life expectancies, rather than ten years.

There are five categories of those who can continue to have lifetime IRA RMDs:

Surviving spouses. The surviving spouse may use the life expectancy tables to take RMDs over his or her lifetime. A surviving spouse continues to have the option of making an inherited IRA his or her own. With that approach, RMDs won’t be required until the spouse reaches age 73, and then they may be spread over the life expectancy.

Minor children of account owner. Until they reach the age of majority, the RMDs for minor children may be determined from the actuarial tables. Once they reach the age of majority the ten-year rule kicks in.

Note that the minor must be the account owner’s child not simply a minor. This tax treatment is not available to grandchildren, nieces, or nephews.

Disabled beneficiaries. If the designated beneficiary is disabled within the meaning of IRC §72(m)(7), RMDs may be stretched over the lifetime. Entitlement to Social Security disability benefits may be a litmus test for eligibility. Note that eligibility is determined at the account owner’s death. If an able-bodied heir who has been receiving IRA distributions under the ten-year rule becomes disabled in, for example, year five, there is no ability to switch over to the life expectancy payouts.

Chronically ill beneficiaries. A chronically ill designated beneficiary, as that condition is defined in IRC §7702B(c)(2), may stretch the payouts over his or her lifetime. Again, at this beneficiary’s death the ten-year rule kicks in.

Less than ten years younger than the account owner. Life expectancy may be used if the heir is less than ten years younger than the account owner, such as a sibling. However, a blood relationship is not required.

The caveat

After the SECURE Act was enacted, estate planners debated how to handle distributions for those in the ten-year category. Should they be deferred until the tenth year, for maximum tax-deferred buildup? Or should a program of taking 10% each year for ten years be better, as it avoids pushing the beneficiary into a higher tax bracket?

When the IRS proposed regulations to implement these new rules, the Service pointed out that most everyone had overlooked another rule. If the account owner was already taking required minimum distributions (RMDs), then the beneficiary also had to take distributions at least that fast. Failure to take an RMD results in a substantial excise tax.

The proposal caught planners and financial institutions by surprise, so the IRS responded by waiving penalties for failure to take an RMD from certain inherited IRAs in 2021, and again in 2022 and 2023. In IRS Notice 2024-35, issued last month, the penalties are again waived for 2024. The Notice suggests that this is the last year for such forbearance.

The Notice affects only those who inherited an IRA in 2020 or later from someone who was then old enough to be required to take RMDs.

If you might be affected, see your tax advisor to learn more.

Source: IRC; M.A. Co.

© 2024 M.A. Co. All rights reserved.

Some information provided in the Knowledge Center may be obtained from outside sources believed to be reliable, but no representation is made as to its accuracy or completeness. This information is intended for discussion purposes only and should not be considered a recommendation. The information contained herein does not constitute legal, tax or investment advice by Country Club Trust Company. For legal, tax or investment advice, the services of a competent professional person or professional organization should be sought. Trust services and investments are not FDIC insured, are not guaranteed by the Trust Company or any Trust Company affiliate, and may lose value. Past performance is no guarantee of future results.