ALM Basics: Non-Maturing Deposits

**Note: This post is part of a series on the basics of asset liability management.

One of the most important concepts to understand in asset liability management is the behavior of non-maturing deposits. While bank balance sheets have a lot of optionality, most instruments do have contractual maturity dates that heavily influence their cash flows and repricing characteristics. However, non-maturing deposits (instruments such as checking accounts, savings accounts, and money market accounts) do not have a contractual maturity. When evaluating interest rate risk, how do we handle these accounts? What repricing bucket are they included in for GAP purposes? And what is their duration when we measure the economic value of equity?

In order to answer these questions, we need to have an understanding of how the account holders behave. This requires a study of a bank's deposit accounts that estimate both the age of the existing accounts (i.e. how long the average account has been open) as well as the retention rate of those accounts. The turnover of accounts is often referred to as the decay rate of deposits, which is just that, an estimate of the speed at which the accounts "decay" or roll off the books as if they have matured. A retention rate is the inverse of a decay rate, and is simply another way of measuring the same effect. The simple calculation would then look something like this:

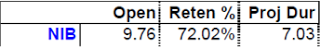

In this case non-interest bearing accounts (NIB) have been open for an average of 9.76 years, and have a recent retention rate of 72.02%. This would translate to a duration for these accounts of 7.03 years.

With this method we now have an effective maturity for non-maturing deposits that we can use for estimating market value of equity. We also have an idea of how stable these liabilities are, and can better match our assets with our funding sources. This analysis shows why non-maturing deposits are so important, especially to community banks. In our example, we have a 7 year funding source with a rate of 0%. Having an abundance of this kind of funding allows a bank to build an asset base with little credit or interest rate risk that still generates a healthy spread. For this reason, banks with healthy deposit bases have more intrinsic value, and command higher premiums when being purchased.