Swap Rates Off to the Races (Again)

by AMG

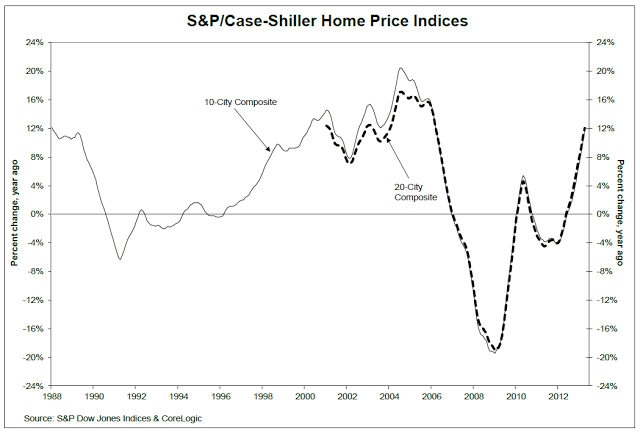

Is the big move up in rates finally here? I have been skeptical to this point, and quite frankly I am surprised at how the rates seem to refuse to bounce back. Unfortunately, much of the move has been Fed driven instead of by strong economic numbers. However, that may be changing, even if just marginally. The two big drivers to a true economic recovery will be housing and employment. First, let's look at housing, via the latest reading from the Case-Shiller index:

As you can see, the hole was quite deep, but the trend looks great. The issue, of course, is the simple arithmetic behind the losses. A 20% loss requires a 25% gain to get back to even. A 50% loss requires a 100% gain. Given the size of the losses from 2008 to 2010, even the 12% annualized gain doesn't have us back to the highs just yet. But we are definitely healthier.

Second, from today's payroll report:

Payrolls rose by 195,000 workers for a second straight month, the Labor Department reported today in Washington. The median forecast in a Bloomberg survey projected a 165,000 gain after a previously reported 175,000 increase in May. The jobless rate stayed at 7.6 percent, while hourly earnings in the year ended in June advanced by the most since July 2011.

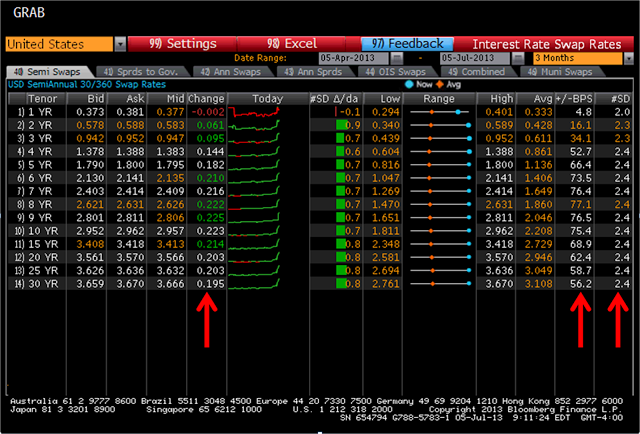

The result this morning is that rates are again screaming higher. Check out today's LIBOR swap rates:

I have added three arrows to point out just how impressive a move this is. From left to right:

- This column shows how far the swap rates have moved today. I am not shocked by a 20 basis point move in the 10 year part of the curve and longer, but take a look at the 5 to 7 year range. The five year is all the way up to 1.80%!

- The second arrow shows how many basis points we are away from the average for the last 3 months. The 10 year swap is 75 basis points above the average, and a whopping 115 basis points above the low.

- Perhaps most impressive is the third arrow, which shows how many standard deviations the current rate is from the mean. Every swap is at least two standard deviations away.

Given these numbers, we still believe that a reversion to the mean is inevitable. However, keep in mind the advice from John Maynard Keynes. "The market can stay irrational longer than you can stay solvent."

I am working on another post for next week where we will talk about what banks should be doing in this new rate environment. Even if we are headed back down, the volatility is certainly a new factor, and one for which we need to be properly prepared.

Note: Clicking links within this email may take you to websites other than Country Club Bank's.