Swaps Basics: Risks and Benefits

by AMG

**note: this post is part 4 of a series, "swaps basics." click here for the rest of the series

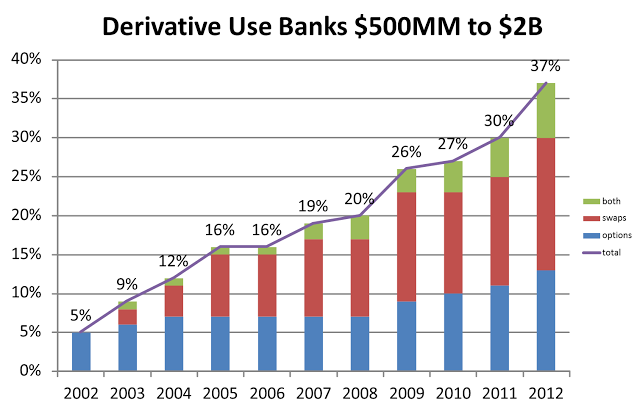

We noted in a post a couple of months ago that swaps use has increased dramatically in smaller banks. This chart from that post speaks volumes:

|

| Data via SNL |

That means that a lot of small banks have gone through the due diligence process in evaluating derivatives. We have been a part of quite a few of these with our Hedging and Derivatives Advisory services, and there are two questions that are common to every evaluation, especially at the board level:

- What is the benefit of using derivatives (and swaps specifically)?

- What are the added risks?

These two questions are the crux of the issue, and the banks that get comfortable with the answers will have access to tools that lead to a much more efficient balance sheet. This table covers the main points:

BENEFITS

- Flexibility - the interest rate swaps market is incredibly deep and highly liquid, with hundreds of trillions of dollars in notional outstanding exposure. This means that essentially any specific risk that a community bank may encounter can be hedged with a swap. They are extremely flexible, and can be made to fit nearly any structure and size necessary.

- Customization - transactions can be customized to fit specific needs based on structure, size, timing, coupons, etc. If banks want to hedge interest rate risk at the loan level, the swap can be customized all the way down to the amortization schedule. This allows a bank to hedge exactly the risk they are concerned about, and the perfect match greatly simplifies the accounting.

- Lower cost - interest rate swaps cost less than nearly any alternative hedging method available. For example, using a swap is generally 50 basis points (or more) cheaper than wholesale funding. In a low rate environment like this, every basis point is extremely valuable, and a funding advantage like this cannot be ignored. This is precisely why many of your competitors can offer such aggressive loan rates.

- Less capital required - because swaps are off balance sheet, they require much less capital than on balance sheet alternatives. Ballooning the balance sheet unnecessarily is extremely expensive in this regulatory environment (hello, Basel III!).

RISKS

- Credit risk to counterparties - this is generally the first risk brought up by community banks, which is largely a result of the 2007-09 turmoil in the financial markets. While this is certainly a risk that needs to be monitored, it should not be a deterrent from using swaps in and of itself. A few things to keep in mind - first, you are not exposed for the full notional amount, but just the net difference in interest accruals based on that notional amount. Second, you should only do business with credit worthy counterparties (and there are plenty of them, including some of the FHLBs, which are GREAT counterparties for small banks). And third, your risk is mitigated by the bi-lateral collateral agreement, whereby any exposure above a predefined threshold is collateralized via a margin call. You can also have a slight additional exposure to a borrower if you are swapping an individual loan (email me if you want specifics on this).

- Hedge accounting - derivatives are required to be marked to market through the income statement unless the qualify for hedge accounting under FAS 133 (now ASC 815). FAS 133 can be quite complex, and if the markets behave in unexpected ways, a value change that is sitting on your balance sheet could suddenly end up in the income statement. In general, the more complex the structure and transaction, the more complex the accounting. Small banks SHOULD be sticking to simple structures anyway, with one of the reasons being that it greatly simplifies the accounting. For a well structured hedge, there is minimal potential for accounting surprises. However, smaller banks should always consult with their auditors when executing hedges, if for no other reason than to verify that they interpret the accounting rules the same way you do.

- Liquidity - the bi-lateral collateral agreement goes both ways, meaning that if rates move against you, the margin calls will go the other way and you will have to produce collateral. This should be a beneficial rate movement since you were hedging the opposite outcome. However, it is vital that the bank do rate shocks on a swap before executing to ensure that margin calls can be handles from a liquidity perspective. In addition, all swaps should be evaluated as a whole to make sure that a big rate move does not cause too many margin calls all at once.

There are certainly other benefits and potential risks depending on your specific situation, but these are the most important. Bankers are quite familiar with doing due diligence before acting, so as long as community banks stick to simple transactions that are easy to understand, quantifying and preparing for the risks should be doable. Let us know if we can help with that process.