FASB’s New Swap Rules means “Christmas Comes Early” for Community Banks

The Financial Accounting Standards Board (the “FASB”) issued their Derivatives and Hedging Update on August 28, 2017.

A bank may elect Early Adoption of these rules, or wait until they become effective on January 1.

The new rules:

- Simplify derivative accounting compliance

- Provide more hedging strategies to qualify for hedge accounting treatment, and

- Align the fair value measurements of a hedge with the underlying exposure.

The new rules allow community banks to apply fair value hedge accounting to swaps used to hedge portfolios of long-term fixed rate assets (loans and MBS).

Changes:

- When hedging a portfolio of assets, community banks can now hedge a partial-term of the portfolio. This change is important because it eliminates the maturity mismatch between the derivative and the hedged portfolio that existed previously.

- Community Banks are allowed to exclude prepayments on loans in hedged portfolios when measuring the fair value of the hedged item(s) in the portfolio.

Together, these two changes facilitate partial-term hedging of fixed rate loan portfolios, even where those loans do not include pre-payment penalties.

The new rules allow a Community Bank to designate the “last-of-layer” of a loan portfolio in hedges of fair value. This designation removes pre-payment risk as a barrier to prove effectiveness in designating a hedge relationship. The “last-of-layer” assumes that prepayments, defaults, and the like are first applied to unhedged loans, allowing for hedged loans to be predictably included in the hedging relationship. Additionally, in a fair value hedge of interest rate risk, changes in fair value of the loan portfolio is recorded in earnings to offset derivative gains or losses.

Bottom Line: a Community Bank can now seamlessly hedge economic exposure in the portfolio, and qualify for the more palatable hedge accounting treatment.

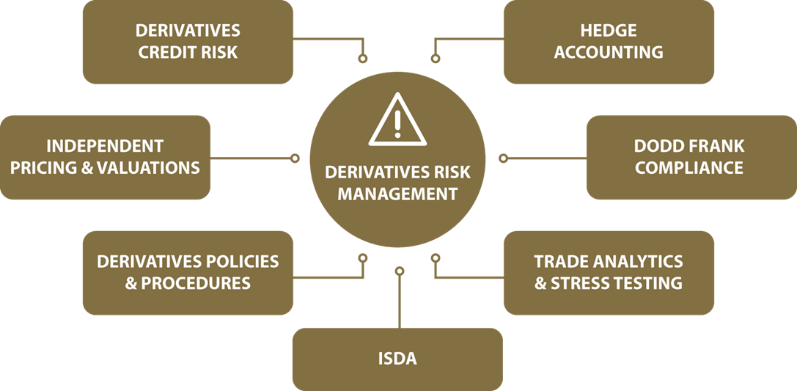

BancPath works with our partners at Provident Risk Management to deliver well-structured hedging solutions to the community bank marketplace. We work with banks to deliver a “turn-key” solution, from developing derivatives policies, propose hedge accounting solutions, structure swaps, manage executing dealers and provide on-going reporting.