How EBITDA Affects Valuation

By: Tyler Clement

When it comes to M&A, company valuations are commonly derived by a buyer assigning a multiple of EBITDA that they are willing to pay for that company. A quick example: Let’s say a buyer offers a seller five times (“5x”) the company’s last twelve months (“LTM”) EBITDA. If a selling company’s LTM EBITDA is $2 million, the buyer is valuing the business at $10 million. More information on how buyers arrive at that multiple – and all the factors that are considered – can be found here. Today, we will instead focus solely on the basis for that multiple and how there are certain EBITDA thresholds that can naturally increase the valuation of the company.

What is EBITDA?

First, let’s define EBITDA. EBITDA stands for Earnings Before Interest, Tax, Depreciation, and Amortization. Another way to look at the metric is simply the Operating Income of the business plus any depreciation and amortization included in Cost of Goods Sold or Operating Expenses.

EBITDA is a widely used measurement of a company’s profitability, as it is used as a proxy for cash flow. Therefore, to calculate EBITDA, we must add any non-cash expenses such as interest, tax, depreciation, and amortization to represent the company’s cash flow for that period. You can see in the EBITDA graphic above, Company A and B both have the same operating income, but because of the different depreciation and amortization expenses, have different EBITDA results. Additionally, when it comes to utilizing EBITDA as a basis for a transaction multiple, it is common to have EBITDA Adjustments in order to eliminate any one-time events and present a company to buyers with a “normalized” EBITDA. What goes into EBITDA Adjustments is a topic for another day. Instead, we will transition into how the size of EBITDA impacts valuation because of a few key factors.

How the Size of EBITDA Can Affect Valuation

A company can increase its valuation in a sale as it surpasses certain EBITDA “thresholds.” Generally speaking, increasing EBITDA will increase the multiple a selling company can command, all other factors being equal. A manufacturing company with $4 million EBITDA and 15% EBTIDA margins (EBTIDA margin = EBITDA divided by revenues) will be able to command a higher multiple than a company with $2 million EBITDA and the same margins in the same industry. Larger companies are more valuable due to the economies of scale and operating leverage they can employ. Larger companies have the ability to access capital easier (i.e., a bank being more likely to lend money to a larger company).

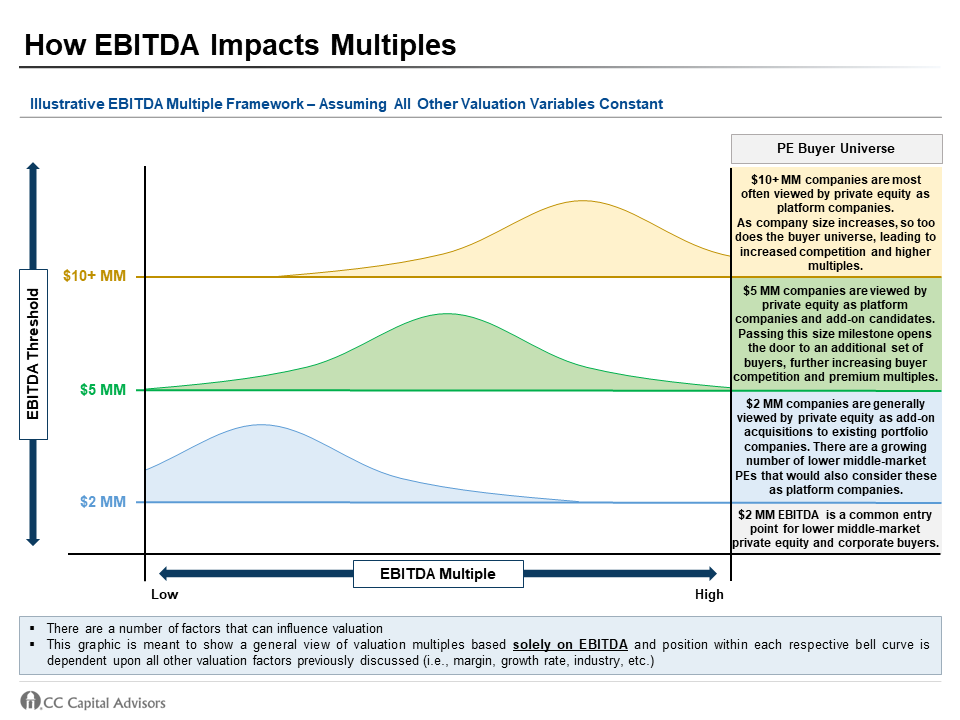

Additionally, EBITDA valuation multiples also increase as EBITDA crosses certain “thresholds” due to another factor: a larger number of buyers. The larger a company gets, the more private equity (“PE”) buyers there are willing to consider acquiring it. There are over 9,000 private equity firms globally, a number that was about half of that just 10 years ago. For PE firms that focus on acquiring majority equity of companies, they commonly have preferences for a target company’s size that they are willing to invest in. While each PE has their own preferences, the chart below shows common minimum thresholds where private equity buyers are willing to enter the conversation as a buyer.

As you can see, $2 million EBITDA is a common minimum EBITDA in the lower-middle market PE universe. A PE in this bucket may list their preference for a target company to be $2 million – $8 million in EBITDA. Companies just above $2 million are viewed in two respects:

- Certain lower middle-market PEs would view these companies as the potential to be a platform company in their portfolio. A platform company is the initial acquisition a PE makes in a certain industry, often with the intent of growing it and selling in 3-7 years. They will attempt to grow via organic operational initiatives, or via “add-on” acquisitions.

- Meanwhile larger PEs would view a company of this size as an add-on acquisition to a company in their portfolio in the same industry. Overall, more and more private equity buyers are becoming open to companies < $2 MM EBITDA, but it is a more limited buyer universe and $2 million is a common entry point to gain access to this first wave of buyers.

The next threshold where a selling company would naturally see a jump in valuation would be crossing the $5 million EBITDA mark. This mark is another common minimum threshold for a portion of the PE universe (i.e., their preference could be $5 million - $15 million EBITDA). Additionally, many private equity buyers that are in play as a buyer at the $2 million threshold for a company would still be in play for a company around the $5 million mark. Companies at this size are viewed increasingly as a platform company given their size but are still also candidates to be an add-on acquisition by large companies.

The last threshold we have outlined in our diagram is the $10 million EBITDA mark. The same result of crossing the lower thresholds occurs here with the door opening to even more potential buyers. The growing buyer universe could arguably be just as important as the size premiums we mentioned earlier: the more buyers competing to purchase a company, the more the valuation increases as buyers know they must pay up to successfully acquire the company over a competitor. This combination of economies of scale and a larger buyer universe pair to make a direct correlation of EBITDA size increasing in line with EBITDA multiples.

Conclusion

As EBITDA grows, so too does the valuation of the company all other factors being equal. But growing EBITDA across certain thresholds will also have the added benefit of additional buyers vying for the company. This increased competition naturally drives up the valuation for companies with buyers. A competitive environment of buyers will only increase the chances of an ideal outcome for a seller. Having an investment bank that can run an effective process to instigate this competitive environment can be vitally important for a seller being able to capitalize on its strong EBITDA and attain a high valuation.