Understanding Net Working Capital in M&A

By: Jack Rusgis

Net working capital (“NWC”) is one of the most complex, but critical components of an M&A transaction. NWC is a commonly misunderstood concept within an M&A transaction, although at its core, the formula is relatively simplistic: current assets minus current liabilities on a company’s balance sheet. However, the determination of a Seller’s NWC is often an intricate process and is unique to the specific M&A transaction at hand. Understanding the basics of NWC and its role in an M&A transaction is essential and can alleviate unwarranted stress, confusion, and potential legal disputes. Below, we break down the fundamentals of NWC and the impacts NWC has on an M&A transaction.

What is Net Working Capital?

The simple definition of net working capital is current assets minus current liabilities. Generally, current assets and current liabilities are expected to generate or use cash within a short-term period, typically 12 months or less. NWC is a measure of a company’s operational liquidity, represents the company’s ability to cover or meet short-term obligations, impacts cash conversion cycles, and is a gauge of a company’s financial health at a point in time. NWC can be a positive or negative amount. A positive or surplus of NWC (ie. current assets are greater than current liabilities) indicates that a company has sufficient funds for current operations, can pay short-term liabilities, and has the ability to invest in future growth initiatives. However, a high level of NWC is not always beneficial as it may indicate that a company has too much inventory on hand and has not been investing excess cash. A negative or deficit of NWC (ie. current liabilities are greater than current assets) can indicate that a company may be having difficulties paying back creditors and can pose limitations on the company’s growth. However, negative net working capital does not always mean that there are problems with a company as the company may receive cash payment from customers immediately or faster than the company pays vendors for goods, services, and materials (ie. retail and telecom companies). Whether NWC is at a surplus or a deficit, a business owner should be equipped with the knowledge and resources to explain and defend the NWC needs of their company. Overall, NWC is an essential metric in analyzing operations and is unique to each company.

NWC’s Role in an M&A Transaction

M&A transactions are typically structured as the sale and purchase of either a company’s assets or equity. As the Buyer will be purchasing the Seller’s assets or equity, NWC will typically be included in the sale and transferred from the Seller to the Buyer at the completion of the transaction. In nearly all M&A transactions, a Buyer will require the Seller to leave behind – and the Seller is obligated to deliver – a defined amount of net working capital. This amount is mutually agreed upon by both parties during the negotiation phases of the transaction. This ensures that the Buyer is not burdened post-close and is positioned with a sufficient level of NWC on day one to generate cash flows and maintain normalized, ongoing operations without the infusion of incremental cash.

From a Buyer’s perspective, this defined amount of NWC is included in the overall valuation of the Seller’s company and ultimately impacts the purchase price. Nearly all M&A deals will include a clause within the purchase agreement for a purchase price adjustment related to NWC (“NWC Adjustment”). This adjustment is intended to capture the change in the acquired entity’s estimated financial condition when the price is set and the actual condition when the transaction closes. On the day of close itself, it is unreasonable for NWC to be 100% determined and is preliminary estimated, so there is time allowed post-closing for the parties to determine the exact amount, which we will discuss shortly.

There are three key definitions of NWC in an M&A transaction, all of which impact have an impact to the purchase price: 1) NWC Target (also called “NWC Peg”), 2) Estimated NWC and 3) Actual NWC. The NWC Target is a negotiated and agreed upon normalized amount of net working capital to be delivered from Seller to Buyer and serves as the benchmark in determining the NWC Adjustment. The NWC Target is the amount that the Buyer expects to receive from the purchase of the Seller’s company. The Estimated NWC is an estimated amount of NWC calculated right before closing. It is not practical to know the exact balance sheet of the Seller’s company on the day of close due to limitations in timely accounting and financial reporting. Therefore, the balance sheet is estimated by the Seller on the transaction closing day. Post-closing, there will typically be a period ranging from 30 to 120 days where the Estimated NWC will be trued-up to Actual NWC once the information necessary to complete this is available.

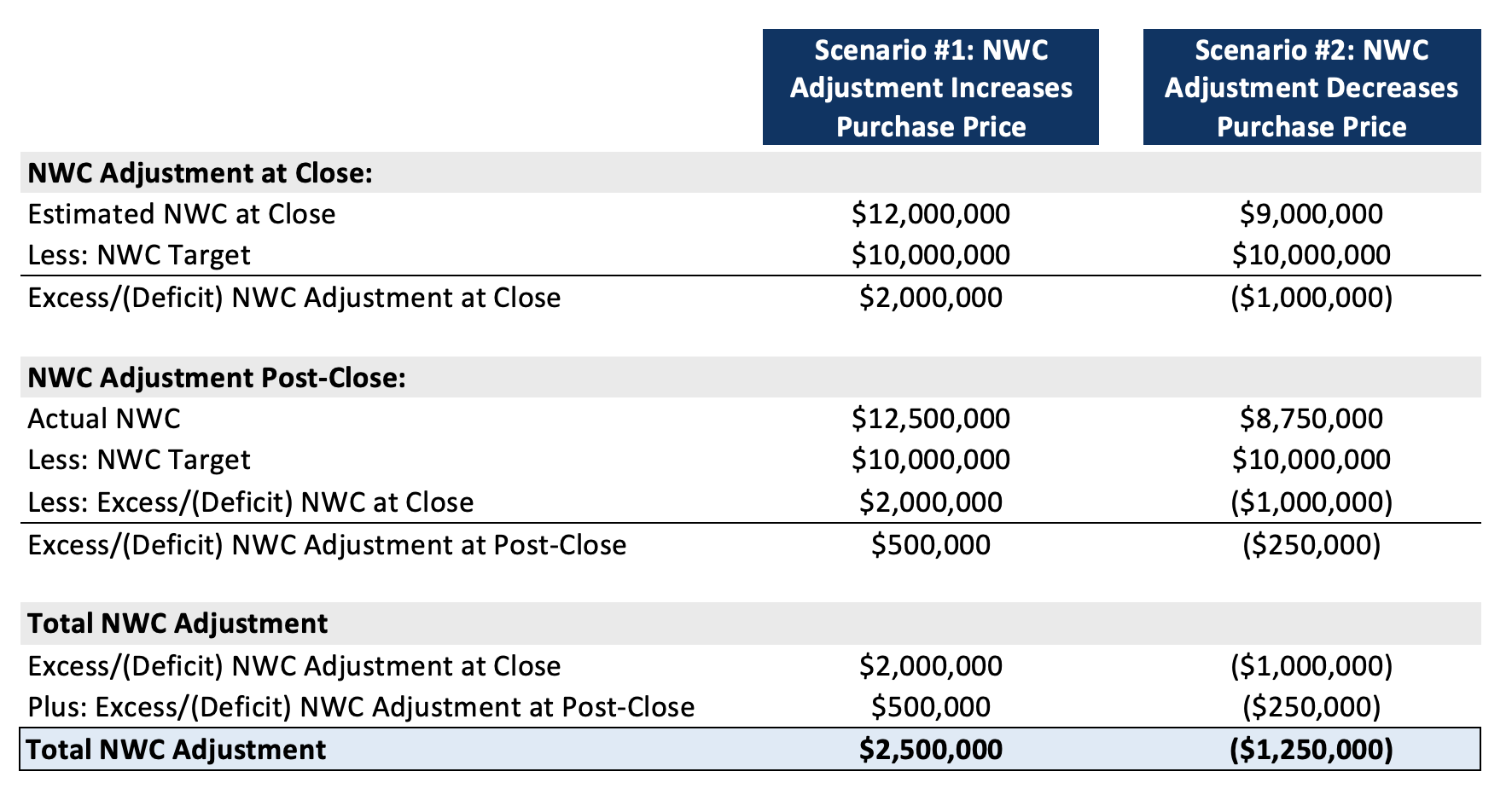

The NWC Adjustment typically has a dollar-for-dollar impact on the purchase price of a Seller’s company. To calculate the NWC Adjustment, the amount of NWC delivered is compared to the NWC Target. If the NWC delivered is higher than the NWC Target, the Buyer pays the Seller the difference, which increases the purchase price. The reason for this increase is because the Seller delivered more NWC than what was required. If the NWC delivered is lower than the NWC Target, the Seller pays the Buyer the difference, which decreases the purchase price as the Seller did not deliver the required and defined amount of NWC.

This calculation occurs at two intervals during a transaction, first at closing and second at post-closing. At closing, the NWC Adjustment is preliminarily calculated by comparing the Estimated NWC to the NWC Target. This difference is included as a purchase price adjustment at the day of closing. Post-closing, the Actual NWC will then be compared to the NWC Target. This difference will be included as a purchase price adjustment post-close, net of the NWC Adjustment included at closing. Below are illustrative examples demonstrating this process.

How to Determine and Calculate the NWC Target

As you may have gathered from the above, the establishment of a defined NWC Target is a critical component to an M&A transaction as there are potential adjustments to the purchase price or ultimate cash consideration to the Seller or Buyer. During financial due diligence, a NWC analysis is prepared, initially by the Buyer, to determine a methodology for calculating and establishing the NWC Target. The Seller may also prepare a NWC analysis outside of the Buyer’s financial due diligence in anticipation of the Buyer’s negotiations. Ultimately, the NWC Target calculation will be mutually agreed upon between Seller and Buyer.

There is no universal formula for establishing the NWC Target calculation as each company is unique. However, there is a common goal in arriving at a “normalized” NWC Target that is a sufficient amount for the Buyer to continue operations post-close. To determine this “normal” level, typically an average NWC over the prior six to 12 months is utilized to represent the Seller’s typical or current state of operations. Utilizing an average over a defined period assists in mitigating seasonality, cyclicality, business growth or decline, macroeconomic factors, and other various timing mechanics. Below are common balance sheet accounts that could be included in the NWC Target calculation. As most M&A transactions are structured on a "cash-free, debt-free" basis, cash and cash equivalents as well as debt-like, interest-bearing liabilities have been excluded from the examples below.

In addition to the basic foundation of NWC (ie. current assets less current liabilities), there are various adjustments to the NWC Target calculation that are identified and quantified during financial due diligence. These adjustments assist in normalizing the NWC Target for definitional, diligence and pro-forma items.

- Definitional Adjustments: Consistent with the common cash-free, debt-free transaction structure, these adjustments remove cash and debt-like items from NWC, such as line of credit, current portion of long-term debt, and accrued interest.

- Diligence Adjustments: These adjustments relate to non-operating items, non-recurring items, normalization items, or accounting methodology changes. Examples of non-operating items could include removal of accrued capital expenditures within accounts payable. Examples of non-recurring items could include removal of transaction-related professional fees and personal expenses within accrued expenses. Examples of normalization items could include year-end adjustments that are not included in monthly balance sheet dates. Examples of accounting methodology changes could include proposing an accrual for unaccrued vacation or bonuses where neither existed before.

- Pro-Forma Adjustments: These adjustments recast historical NWC on an “as-if” basis by applying a current assumption and retroactively adjusting NWC. Examples could include inflation, impact of a prior M&A transaction, new products or services, elimination of positions and more.

Determining the NWC Target in an M&A transaction is a comprehensive process. Below are some common items that both a Seller and a Buyer should consider that may result in NWC adjustments to arrive at a true, representative NWC Target.

- Basis of Accounting: Many companies, particularly lower to middle market, report their financials on the cash basis of accounting, specifically for tax purposes. However, this may not reflect the most accurate amount of NWC at a point in time and may need to be revised to an accrual basis of accounting.

- Adjustments to EBITDA: These include one-time, non-recurring or non-operating expenses that have been accrued for on the balance sheet. Common examples include personal or ownership expenses, discretionary expenses, one-time consulting or professional fees, transaction-related costs, and more.

- Timing of Accounting and Bookkeeping: Accounting and bookkeeping processes can vary across companies. The recording of transactions and financial reporting can occur at differing intervals (ie. monthly, quarterly, year-end) based on what is “standard” to that specific company. As an M&A transaction can occur at any point during the year, there may be misalignment on timing of the financials if a company’s standard process is to accrue specific transactions at the end of the year, when the services rendered or goods delivered were related and should have been included in a prior period.

- Quality of Assets: As indicated above, two of the most common balance sheet accounts are accounts receivable and accounts payable. However, a company may have significantly aged receivables or payables that can be deemed unpayable if sitting idle on the books for an extensive period of time and not reflective of an accurate account balance.

- Related Party: These transactions and related balances may be non-operational and do not occur within arm’s length.

- Unearned Revenue, Cash Received in Advance, Customer Deposits: If a transaction is structured on a cash-free, debt-free basis, the Seller is allowed to keep the cash on the balance sheet and is obligated to pay off identified debt-like items. However, if a company has received cash in advance of performing services or delivering goods, the Buyer will then be obligated to provide those services or goods post-transaction. These amounts may be identified as debt-like items or the Seller may be required to leave a certain amount of cash in the company so that the Buyer can satisfy these obligations post-close.

Conclusion

Establishing and defining the NWC Target is a highly negotiated process with an M&A transaction given the vast number of variables included. Having a clear understanding of a company’s balance sheet, performing a comprehensive NWC analysis, agreeing to the inclusions and exclusions of specific balance sheet accounts, and thorough documentation within the purchase agreement can result in an array of benefits to both the Seller and the Buyer throughout this process. These include, but are not limited to, developing the NWC Target, identifying debt and debt-like items, preventing future disputes, undesired transaction distractions and associated costs, quality of current assets and liabilities, and NWC requirements for operations post transaction.

NWC is a critical component to any M&A transaction and serves as an important metric for both a Seller and a Buyer as it provides insight into a company’s financial health. The spirit of NWC is that there are “no winners and no losers” and must be fair and equitable to both parties involved as the Buyer will need a sufficient level of NWC to generate cash flows and continue to support operations post-close. An M&A transaction is a pivotal milestone in a company’s life cycle and understanding the role NWC plays in an M&A transaction can lead to a smooth transition as the company begins its next phase of ownership. NWC can be a complex process in an M&A transaction and engaging an experienced investment bank can help business owners navigate through the nuances and negotiations of NWC for an optimal outcome.