What is Adjusted EBITDA?

By: Jack Schanze

Most business owners have either heard of or are familiar with EBITDA (if you are unfamiliar, you can learn more about EBITDA here). EBITDA is commonly used as a proxy for free cash flow and therefore most often serves as the valuation basis in a transaction. If you’ve ever heard someone say, “I received ‘eight times’ for my business!”, that means the business was valued at EBITDA multiplied by eight. The referenced EBITDA is almost always the company’s adjusted EBITDA rather than the reported EBITDA. So, what exactly is the difference between the two?

Calculating a company’s reported EBITDA is just simple math, calculated as Operating Income + Depreciation and Amortization in a “top-down” approach. This approach ignores any non-operating income or expense recorded below the operating income line, and is common in M&A transactions. Items such as PPP income, interest income, miscellaneous income, or any other income/expense not generated by the company's core operations can be caught up in a “bottom-up” approach that is calculated as Net Income + Interest Expense + Taxes + Depreciation and Amortization. A buyer will inevitably remove any non-operating or non-recurring items from the EBITDA calculation anyway, so the "top-down" approach is a quicker, more straightforward way to get to the same figure.

Determining adjusted EBITDA is a more nuanced calculation that aims to represent the company’s free cash flow in a post-close environment or, more simply, earnings under new ownership. Adjusted EBITDA is calculated as reported EBITDA +/- any one-time, non-recurring items and items impacting the income statement that are not considered necessary to the ongoing operations of the business. In some cases, owners may run personal expenses through their business, such as personal travel, entertainment, sports tickets, car payments, or personal credit cards. Other examples of one-time, non-recurring items can include non-market compensation for owners or employees, non-recurring legal fees, or major software upgrades.

Additionally, adjusted EBITDA can be negatively adjusted for any items not currently expensed through a company’s income statement that would need to be expensed under new ownership. An example of this would include an active owner or employee that is compensated on a non-salary basis that would not continue with the business post-transaction. For instance, if an owner is compensated only through dividend distributions, adjusted EBITDA would be reduced to reflect the expense new ownership would incur to fill that position post-close.

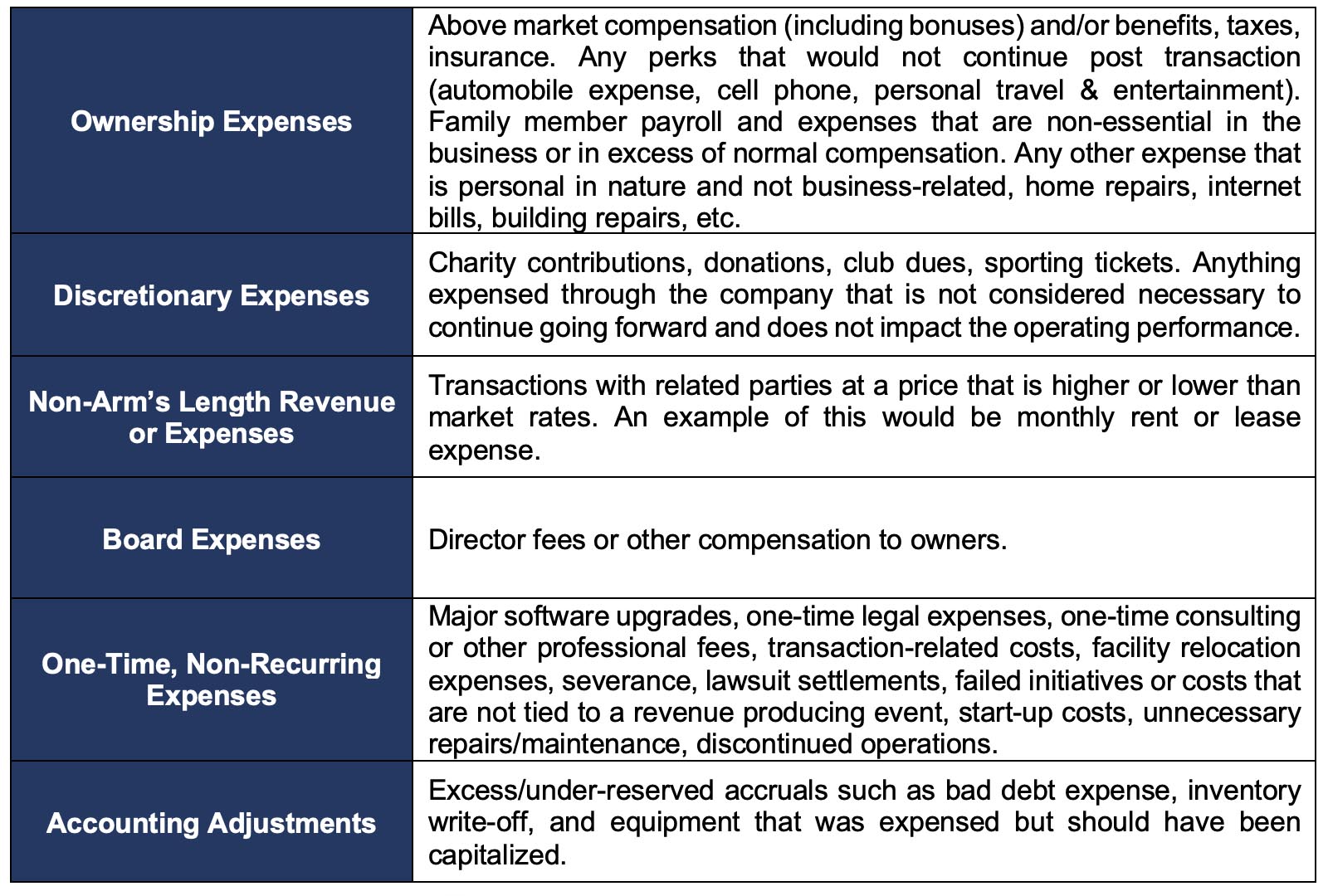

A more robust listing of adjustments can be found in the graphic below.

Examples of Common EBITDA Adjustments:

Most often, adjusted EBITDA and the related add-backs are the first financial-related item that a buyer wants to fully understand. Once a buyer is comfortable and in agreement on the respective adjustments, the focus shifts to the quality of the underlying financials. Buyers will want to be sure that the company’s financial reporting is “GAAP-compliant" (meaning the financials adhere to Generally Accepted Accounting Principles), if the financials are stated on an accrual basis, and if the financials are audited or reviewed by a CPA.

GAAP compliance is crucial to establishing the basis of your financial reporting, and buyers and their financiers will usually require GAAP-compliant financials in order to underwrite a transaction. Accrual-basis accounting provides a smooth, consistent view of financial performance as opposed to cash basis accounting. Accrual methodology recognizes revenue and expenses when a product/service is delivered, and the associated expenses are incurred, whereas cash basis methodology recognizes revenue at the time cash is received and expenses are incurred, leading to a bumpier view of financials. Having audited or reviewed financials is a testament to the sophistication of a company’s financial reporting and always helps provide a buyer with more comfort on the underlying financials. However, buyers are increasingly subjecting businesses to a Quality of Earnings review to substantiate the quality of the underlying financials, regardless of a CPA’s involvement in preparing your financial statements. To better understand what constitutes strong financial reporting, please refer to How Robust is your Financial Reporting.

When it comes to adjusted EBITDA, the devil is in the details. Stated adjustments often face heightened scrutiny from buyers since adjusted EBITDA serves as the basis for valuation, thus requiring a strong defense on the figure that is presented. Utilizing an experienced investment banker can help your business identify the steps it should take to prepare for a sale, recognize market EBITDA adjustments, understand the strengths and weaknesses of your financial reporting and serve as the first line of defense for your adjusted EBITDA.