About Statements and Documents

Statements and Documents allows company users to view statements and other documents, such as notices, for analysis, checking, loan, and savings accounts.

When a company is set up with Statements & Documents service that company's Administrator is responsible for setting up accounts for online delivery of statements and documents. Company administrators are also responsible for reviewing and accepting service agreements/disclousers relative to statements and documents.

The Manage Alerts page includes alerts to which company users can subscribe to be notified automatically when statements and documents are available.

Setting up Business Online Statements & Documents

Company administrators are responsible for setting up accounts for online delivery of statements and documents.

-

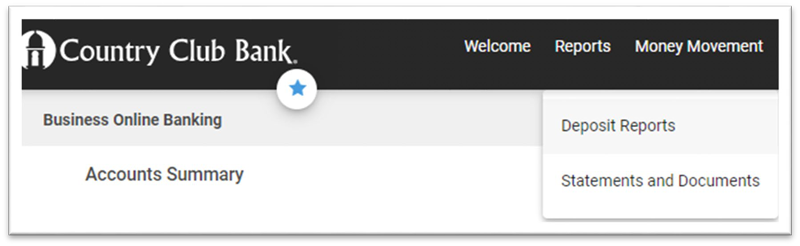

Click Reports > Statements and Documents

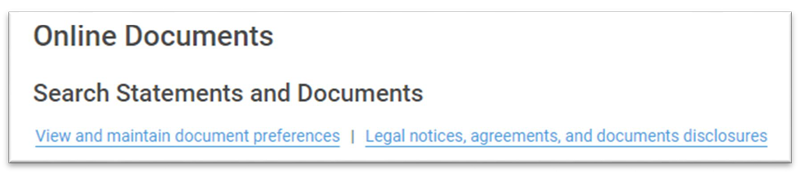

- Click the View and maintain document preferences link

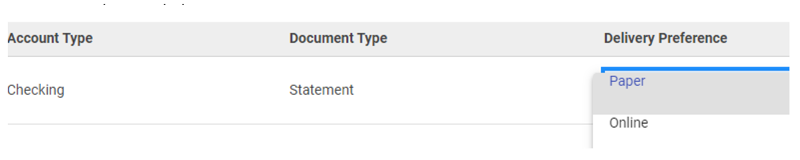

- Click the Delivery Preference drop-down beside an account and then select one of the following: Online, Online & Paper, Delivery Preference. Online should be used for combined online statements for the primary account. Online & Paper enrolls the account for online statement/document delivery and continues the delivery of the paper statement.

-

Click Continue.

-

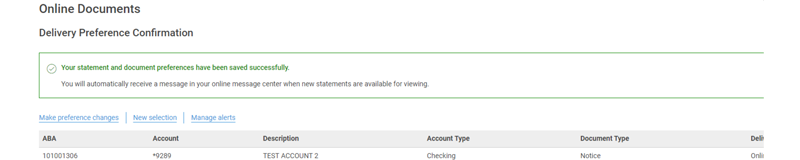

If applicable, review the service agreement and click I agree to accept it.

-

Click Save Preferences.